International Centre for Asset Recovery

Working globally to strengthen asset recovery capacity, practice and policy

The International Centre for Asset Recovery (ICAR) is a specialised centre of the Basel Institute on Governance. Through ICAR, we help governments around the world build their capacity to investigate corruption, cooperate internationally and recover or return assets for the benefit of citizens.

Our teams of investigators, prosecutors, trainers and legal advisors work with government partners across four continents to:

- provide direct support on major corruption and asset recovery cases involving complex money laundering schemes and high-profile suspects. National agencies we support confiscated or returned more than USD 60 million in 2024 alone, with billions more currently targeted.

- build long-term capacity for financial investigations and asset recovery through scenario-based training programmes, eLearning and train-the-trainer initiatives.

- help partners develop and apply powerful tools such as non-conviction based forfeiture laws and to develop framework agreements governing the return of assets to victim states.

- strengthen leadership and foster cooperation through international networks and partnerships, and by building communities of practice that drive asset recovery forward.

Learn more about ICAR’s approach, relevance and strategic priorities in the ICAR Operational Strategy 2025–2028.

News

Featured tools and training

Basel STUDY: postgraduate programme

Boost your career with our six-month Certificate of Advanced Studies on Combating Financial Crime Through Asset Recovery together with the University of Basel

Frequently asked questions

- What is asset recovery?

-

Asset recovery involves the confiscation of illicit assets, usually the proceeds of crime, and the return of these assets to the legitimate owner(s). Assets can take the form of money or other items of value, for example real estate, precious metals, investments such as shares, virtual assets such as cryptocurrencies, race horses, luxury goods, or an aeroplane.

Asset recovery can be a purely domestic process when the funds have been hidden or invested in the jurisdiction where they were illegally obtained. It can also be international, when the funds have been sent to another jurisdiction.

The process of asset recovery is complex but generally covers four basic phases:

- pre-investigation (verification of information);

- investigation (often including seizing/freezing assets and international cooperation to obtain intelligence or evidence);

- judicial proceedings (following which the court may issue a confiscation order for the assets); and

- disposal or return (where the assets are returned to the rightful owner).

For more details, see Tracing Illegal Assets – A Practitioner’s Guide or the Guidelines for Efficient Recovery of Stolen Assets.

Note: ICAR is exclusively dedicated to the recovery of public (government) assets, often in cases of grand corruption. The practice also exists in relation to assets misappropriated from the private sector. ICAR is not active in this practice.

- Why is asset recovery important in preventing and combatting corruption?

-

First, for its deterrent effect. People are more likely to engage in corrupt behaviour if they are confident that – even if they are caught and convicted – they and their families will still be able to enjoy their illegally obtained wealth. Recovering illicit assets helps deter corruption by turning it into a higher-risk, lower-reward activity.

Second, by convicting corrupt officials and recovering stolen assets, countries can also generate funds for development and strengthen their criminal justice system. The end results are stronger rule of law, integrity and trust in government.

Read more in the ICAR Operational Strategy 2025–2028.

- How does ICAR contribute to the Basel Institute’s anti-corruption mission?

-

As a specialised centre of the Basel Institute on Governance since 2006, ICAR is dedicated to supporting partner jurisdictions to recover illicit assets misappropriated through corruption and other financial crimes. Our teams work through four main lines of intervention:

- Case advice, mentoring and facilitation of international cooperation

- Capacity building / training

- Institutional development and legal / policy advice

- Global policy dialogue and innovation

- Does ICAR’s work have wider benefits?

-

Yes. We believe that supporting countries in recovering stolen assets and promoting sustainable development are mutually reinforcing. Helping countries recover stolen assets can mobilise important resources to finance development or poverty reduction efforts.

The asset recovery process itself also plays a critical role in strengthening some key foundations of sustainable development, such as the rule of law as well as strong, transparent and accountable institutions.

Read more in our Working Paper 29: Recovering assets in support of the SDGs – from soft to hard assets for development

- In which countries does ICAR work?

-

Headquartered in Basel, Switzerland, ICAR works with and in partner countries across Central Europe, Sub-Saharan Africa, Asia and Latin America.

- With which public institutions does ICAR work?

-

Our main counterparts include:

- National authorities mandated to investigate corruption, for example, a country’s Anti-Corruption Bureau or a specialised division within the police

- Attorney General’s Offices/Public Prosecutor’s Offices

- Financial Intelligence Units

- Judiciary

- How is ICAR funded?

-

Currently, five government donors support ICAR with core funding:

- Bailiwick of Jersey

- Principality of Liechtenstein

- Norwegian Agency for Development Cooperation (Norad)

- Swiss Agency for Development and Cooperation (SDC)

- UK Foreign, Commonwealth & Development Office (FCDO)

-

Several dedicated country programmes received additional earmarked support from our core donors' country offices or from other donors.

- To whom is ICAR accountable?

-

We are accountable to the beneficiary governments for what we promise to deliver in our mutually agreed frameworks and work plans.

We are also accountable to our core donors and project donors through different reporting mechanisms and a comprehensive monitoring and evaluation system. Core donors participate in the formulation of our four-year operational strategies and take part in a steering committee.

The quality, strategic direction and integrity of our work is overseen by the Basel Institute’s Board.

- Who works for ICAR?

-

Currently ICAR has a team of approximately 40 staff, with the majority based in the field in ICAR partner countries.

The team includes practitioners in financial intelligence and analysis, investigation and/or prosecution with relevant backgrounds in asset recovery and financial crime. We also have programme managers and coordinators in place to ensure our programmes are run smoothly and effectively, achieving the goals set together with our partner countries.

-

- What support do you offer in terms of actual cases?

-

Our asset recovery specialists work hand-in-hand with practitioners in our partner countries to tackle complex international financial crime cases. We are currently assisting with around 100 high-stakes cases across 30 countries.

Our assistance takes the form of advice in the following fields:

- Intelligence gathering and analysis

- Asset tracing

- Financial profiling

- Investigation and prosecution strategies

- International cooperation and mutual legal assistance

Many of our experts are embedded in partner institutions, where they can provide closer support more efficiently and build the necessary relationships and trust.

Through our technical assistance and on-the-job coaching, we not only help to advance individual asset recovery cases but also develop skills and good practices among the practitioners we work with. That often leads to long-term reform processes to give practitioners the legal and institutional frameworks necessary to operate effectively.

- What kind of legal and policy advice do you provide?

-

While assisting with asset recovery cases, we help to identify and address gaps in national laws, policies and practices. Common challenges are:

- Poorly developed processes for building and documenting cases

- Lack of, inadequate, contradictory or unclear legal framework

- Weak/inefficient international networks

- Lack of domestic inter-agency cooperation

- Infrastructure and technology deficits

- Insufficient security of staff, documents and communications

- Agencies lacking autonomy

We also help our partner countries to meet the requirements of international treaties and recommendations, such as the United Nations Convention against Corruption, the OECD Anti-Bribery Convention and the FATF Recommendations.

- What kind of policy advocacy do you engage in?

-

Globally and domestically, many hurdles still exist that make asset recovery too difficult, too slow and too costly. With our hands-on insight into the practice of asset recovery in a wide range of countries, we are well placed to support global efforts to make asset recovery simpler and more efficient.

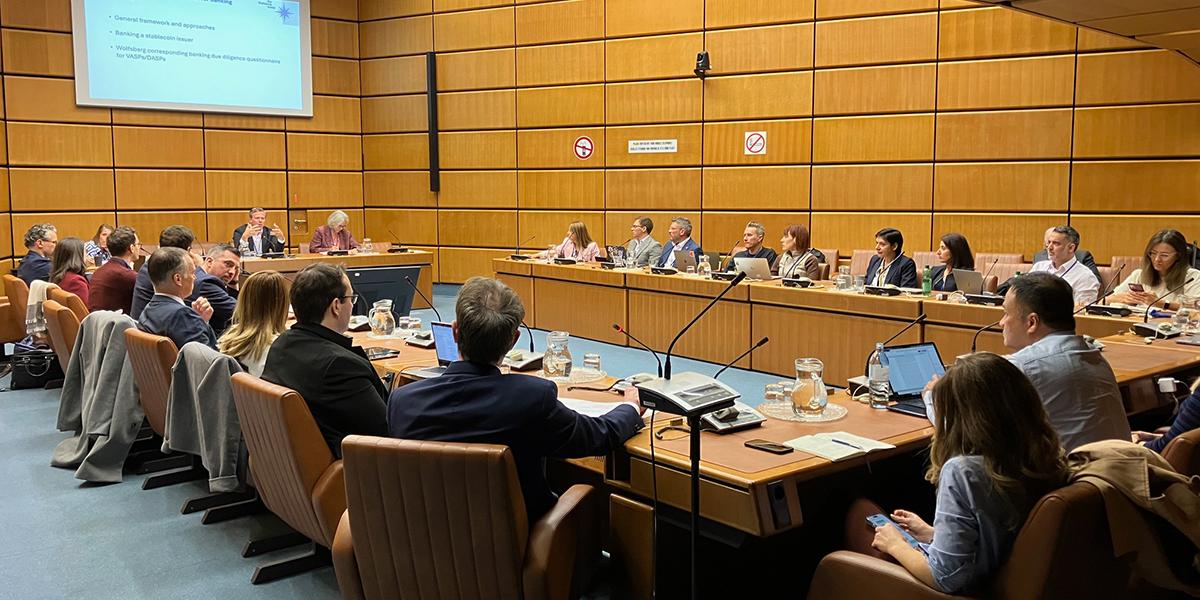

We therefore participate in global forums on asset recovery, sharing our on-the-ground experience to contribute to the development of global good practices, simplified procedures and a strategic international framework.

Examples include:

- Illicit Enrichment: A guide to laws targeting unexplained wealth – an open-access and freely available book on illicit enrichment laws and their application to target unexplained wealth and recover proceeds of corruption and other crimes.

- Boosting co-operation in asset recovery: Exploring the potential of private sector engagement and public-private collaboration – a result of the 11th Lausanne Seminar initiative of the Swiss Federal Department of Foreign Affairs – Directorate of International Law, in collaboration with ICAR and the Stolen Asset Recovery Initiative (StAR) of the World Bank and UNODC.

- Guidelines for the efficient recovery of stolen assets – a result of the Lausanne Seminar initiative and collaboration as above.

- Guide to the role of civil society organisations in asset recovery – developed in the context of the Arab Forum on Asset Recovery.