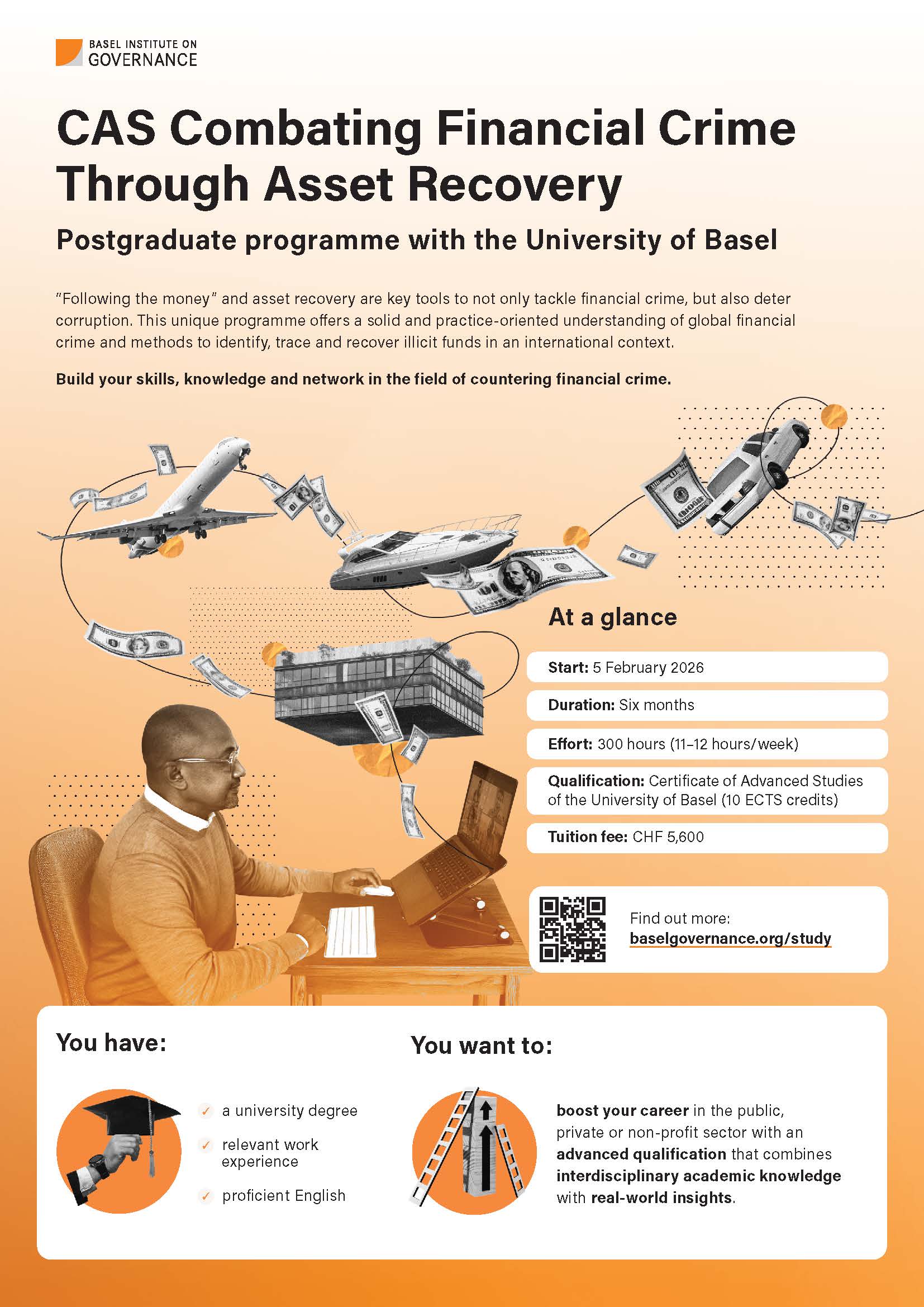

Combating Financial Crime Through Asset Recovery

Certificate of Advanced Studies

At a glance

- Start: Next start date to be confirmed

- Duration: Six months

- Effort: 300 hours (11–12 hours/week)

- Qualification: Certificate of Advanced Studies of the University of Basel (10 ECTS credits)

- Delivery: Live online sessions; 2 hybrid events in Basel (in-person optional); interactive learning material

- Tuition fee: CHF 5,600

+41 61 201 18 25

study@baselgovernance.org

Learn to trace and recover illicit funds

This unique programme will give you a solid understanding of "following the money" and asset recovery as a tool to tackle financial crime.

Led by experts from our International Centre for Asset Recovery, the course offers a practice-oriented understanding of global financial crime and methods to identify, trace and recover illicit funds.

It balances practical exercises with a solid grounding in relevant concepts and technical innovations from different academic disciplines.

Through the live discussions, hands-on activities and practical assignments, you’ll also develop your competencies in analysis, problem-solving, collaboration and leadership.

Join us to build your skills, knowledge and network in the field of countering financial crime.

What you'll learn

The learning objectives of this programme are:

- Understand financial crime and asset recovery in an international context.

- Master the essential phases, challenges and limitations of the asset recovery process.

- Evaluate real-world asset recovery investigations.

- Create a tailored asset recovery project for your professional context.

- Enhance your skills in analysis, problem-solving, presentation, leadership and effective collaboration.

- Strengthen your role as a leader or specialist in asset recovery and countering financial crime, with a focus on career development.

Is this course for you?

This programme is aimed at individuals with a university degree and relevant work experience. It's ideal if you wish to advance your career by gaining a prestigious academic qualification on financial crime and asset recovery.

It's especially targeted to professionals from:

- Law enforcement and criminal justice, such as anti-corruption agencies, customs and border protection, police, prosecutors and judges.

- Government and public administration, especially tax and revenue authorities, financial intelligence units, intelligence and security services and international cooperation units.

- Law, including financial crime litigation, AML/CFT or internal investigations.

- Private sector, particularly specialists in cybersecurity, digital forensics, forensic accounting and auditing.

- Non-profits and international organisations focused on financial crime.

- Education and science, from academics and researchers to teachers.

- Journalism and the media, especially investigative reporters.

Participants with other backgrounds may be admitted.

We bring together a diverse group of participants to foster rich peer learning alongside expert-led teaching.

Your instructors

Instructors include experts and academics from the Basel Institute and University of Basel, with contributions by specialists from different disciplines and sectors. This ensures a balance of academic knowledge and practical insights.

Leading the programme on behalf of the Basel Institute are:

Course structure

The six-month programme combines weekly live online sessions with an online forum for peer learning and reflection. Course materials, including texts, videos, case studies and quizzes, are easily accessible via the University of Basel’s platform.

The programme is structured into five modules: an introductory module, two thematic modules, an application module covering the asset recovery procedure, and a concluding module that brings everything together. A mandatory written online test follows each module.

In addition, you will work on a personal study project throughout the course, allowing you to apply new knowledge directly to your professional context or areas of interest.

The programme opens and closes with in-person events in Basel – 1.5 days over a weekend – but you can follow these virtually if you prefer.

- Introduction: Financial crime in the 21st century – phenomena and implications

-

In the introduction, we jointly elaborate a comprehensive and joint understanding of relevant terms. We introduce the phenomenon of financial crime and outline implications that forms of financial crime have for individuals, states, societies and organisations. This is also illustrated through real-life examples.

Through this exercise, we bring participants from different backgrounds on the same level to start the next modules.

- Thematic module A: Investigating financial crime

-

The first thematic module provides you with a deep understanding of the international legal foundations of financial crime investigations and asset recovery.

We will explore the challenges of today’s investigations into financial crimes, which are generally transnational in nature. We will therefore address issues related to navigating different legal traditions and the relevance of mutual legal assistance (MLA). This involves case examples of different forms of financial crime and the use of technical tools. In this module we will also discuss the concept and forms of assets. Relations to asset recovery are drawn to anticipate the application module.

Thematic module A consists of four live online sessions with interactive lessons delivered through a communications platform. All learning materials will be provided on the University of Basel’s online learning platform.

- Application module: Asset recovery in practice

-

Based on initial aspects from thematic module A, we guide participants through the pre-investigation, investigation, judicial and enforcement phases of asset recovery with their respective foundations, procedures and challenges. We also consider case examples.

The Application module consists of nine live online sessions with interactive lessons delivered through a communications platform. All learning materials will be provided on the University of Basel’s online learning platform.

- Thematic module B: The role of asset recovery in tackling global development and security challenges

-

This second and last thematic module examines asset recovery from a political economy perspective, exploring its role in governance, economic stability and security. It also covers compliance frameworks, cost-effective programme design and the use of international sanctions to disrupt illicit financial networks.

Thematic module B consists of four live online sessions with interactive lessons delivered through a communications platform. All learning materials will be provided on the University of Basel’s online learning platform.

- Conclusion: Financial crime in the 21st century – trends and new challenges

-

The conclusion module summarises the main aspects of the programme modules. Based on that, we discuss the usefulness of asset recovery for combating financial crime in the context of global challenges and development.

This includes how law enforcement and stakeholders from the private sector and civil society can work together. We also address challenges relating to digital technologies, such as blockchain, data analytics and cyber security. In an expert panel (with representatives of relevant organisations from different sectors) we will discuss future challenges of financial crime/asset recovery and venture an outlook on the topic.

The module involves your presentation of your study projects (see below) and their joint discussion.

The conclusion module consists of two live online sessions with interactive lessons delivered through a communications platform. All learning materials will be provided on the University of Basel’s online learning platform.

- Study project: Applying your knowledge

-

Your short individual study project is a central element of the programme and runs parallel to the thematic modules. In this project, you'll directly apply your newly acquired knowledge to a real-world financial crime or asset recovery challenge of your choice – whether from your professional work or an area of personal interest.

Our instructors will give you the necessary guidance and you can discuss your progress with peers. At the end of the conclusion module, you will present your project to the class and submit a short report as a performance assignment.

- Forum and exchange

-

The forum and exchange module serves as a moderated online exchange and networking space for participants throughout the entire programme. Based on guiding questions from the team of instructors, you will reflect on the learning materials and relate your new knowledge to your own area of work.

In this module, we will also discuss relevant skills and career development in the field of counter-financial crime and asset recovery that are helpful for you to take a next step. Participation in the forum complements the performance assignments and counts towards your total marks.

Blended learning approach

This programme is designed for professionals and offers flexible learning alongside work or other commitments. It features live online sessions with interactive group work, discussions and expert input.

Various methods and tools support your personal study, practical exercises, peer exchange and career development. Class sizes are appropriate to ensure active participation and networking opportunities.

Assessments and requirements for graduation

Upon completion, you’ll earn a Certificate of Advanced Studies from the University of Basel, equivalent to 10 ECTS credits. This reflects 300 hours of learning over six months. To graduate, you must:

- Attend at least 80% of live sessions.

- Pass all online tests at the end of each module.

- Actively participate in the forum.

- Complete and present your study project, including submitting a report.

Admission requirements

- Bachelor’s degree (or higher) from a university recognised by the University of Basel.

- 3+ years of relevant professional experience.

You should be able to invest around 11–12 hours per week in your studies, for a total of 300 hours over the six-month programme.

You will need to be proficient in English to actively participate in discussions and complete assignments.

Application process

To apply for the CAS Combating Financial Crime Through Asset Recovery (dates to be confirmed):

- Fill out the electronic application form with some basic information about you and your professional background. You will need to upload a motivation letter (1–2 pages), a resume/CV and copies of your degree certificates.

- Upon submission you will receive confirmation of receipt by email.

- We will review your application.

- If you meet the admission requirements, we will contact you to arrange an interview of around 30 minutes. This will help us to decide whether you can be accepted on the study programme.

- You will be informed about our decision either way.

- If you are accepted, you will receive an invoice for the tuition fee that you will need to pay by the communicated deadline.

Applications are reviewed on a first-come, first-served basis.

Cost

The total tuition fee is CHF 5,600. This includes all costs for admission and registration, teaching, access to online platforms and course materials, and tests.

It does not include any of your personal study costs (for example internet access or printing) or any travel costs if you wish to join us in Basel for the in-person events.

Some employers can provide financial support for your professional development. Please check with yours! We are happy to help with the relevant documentation. There may also be possibilities to apply to the Gretta Fenner Scholarship Fund.

Interested in our postgraduate programmes but not sure what to expect? Join us for an online information session on 24 June at 11:00 CEST. Register here. Alternatively, catch up on a previous info session on YouTube.

Official documents

View this course on the University of Basel website and download the official documents (in German):