Identifying lower and higher risk jurisdictions for money laundering: Basel AML Index re-thinks risk levels

The 14th edition of the Basel AML Index Public Edition – set to be released on 8 December 2025 – will categorise jurisdictions’ financial crime risks using a more nuanced risk-level system.

Experts at this year’s annual review meeting agreed that the change will help Basel AML Index users to better identify lower-risk jurisdictions for money laundering and related financial crimes. The aim is a smarter application of the risk-based approach to anti-money laundering systems, leading to more efficient use of resources and less burdensome application of regulations.

Mitigating financial crime threats

The “risk-based approach” has long been a core element of anti-money laundering and counter-financing of terrorism (AML/CFT) systems.

As a concept, it makes sense: first gain a thorough understanding of the risks, then apply proportionate mitigation measures.

The goal is to focus resources and attention on the aspects that pose the highest threat. The concept applies both to private entities subject to AML/CFT reporting requirements, such as financial institutions, and to jurisdictions developing and implementing AML/CFT regulations and supervisory frameworks.

Poor application = poor results

While the risk-based approach is well established, its application in practice still raises questions and triggers valid criticisms and sometimes unintended consequences.

Poor implementation or misapplication in the private sector, for example, can lead to over-compliance and a “tick-box” mentality. This increases compliance costs and friction for clients while doing little to improve the effectiveness of mitigation measures.

A superficial assessment of risk may also cause financial institutions to “de-risk” by cutting off certain groups of clients or even entire countries. For example, a humanitarian organisation operating in a higher-risk jurisdiction may struggle to access financial services. In extreme cases, indiscriminate de-risking can have even more drastic, long-term unintended consequences for financial systems.

For supervisory and other public authorities, poor application of a risk-based approach can result in burdensome over-regulation, heavy-handed supervision and misleading guidance. A common criticism is that authorities apply rule-based rather than risk-based procedures – blindly following a uniform set of rules for all reporting entities, instead of focusing on what truly matters in preventing or detecting money laundering, terrorist financing or other financial crimes.

In response to this, recent developments in the Financial Action Task Force (FATF) Recommendations – which set global standards for AML/CFT systems – emphasise the importance of proportionality in applying a risk-based approach. A more nuanced understanding of lower-risk jurisdictions, products or clients is encouraged.

Basel AML Index risk levels considered at expert review meeting

The Basel AML Index has long been a leading independent tool for assessing geographical risks of money laundering and related financial crimes. The subscription-based Expert Edition allows users to assess risk levels for 203 jurisdictions across 17 indicators. (Subscription is free for most users outside the private sector.)

Due to the tool’s importance in assessing jurisdictions’ risk scores, we hold an annual expert review meeting to consider the Basel AML Index methodology and ensure it remains accurate, transparent and reflective of evolving financial crime risks.

Experts in AML/CFT and risk assessment methodologies from the public and private sectors, international and non-profit organisations, and academia discussed possible refinements to the current risk levels during the two-part review meeting on 15 and 16 September 2025.

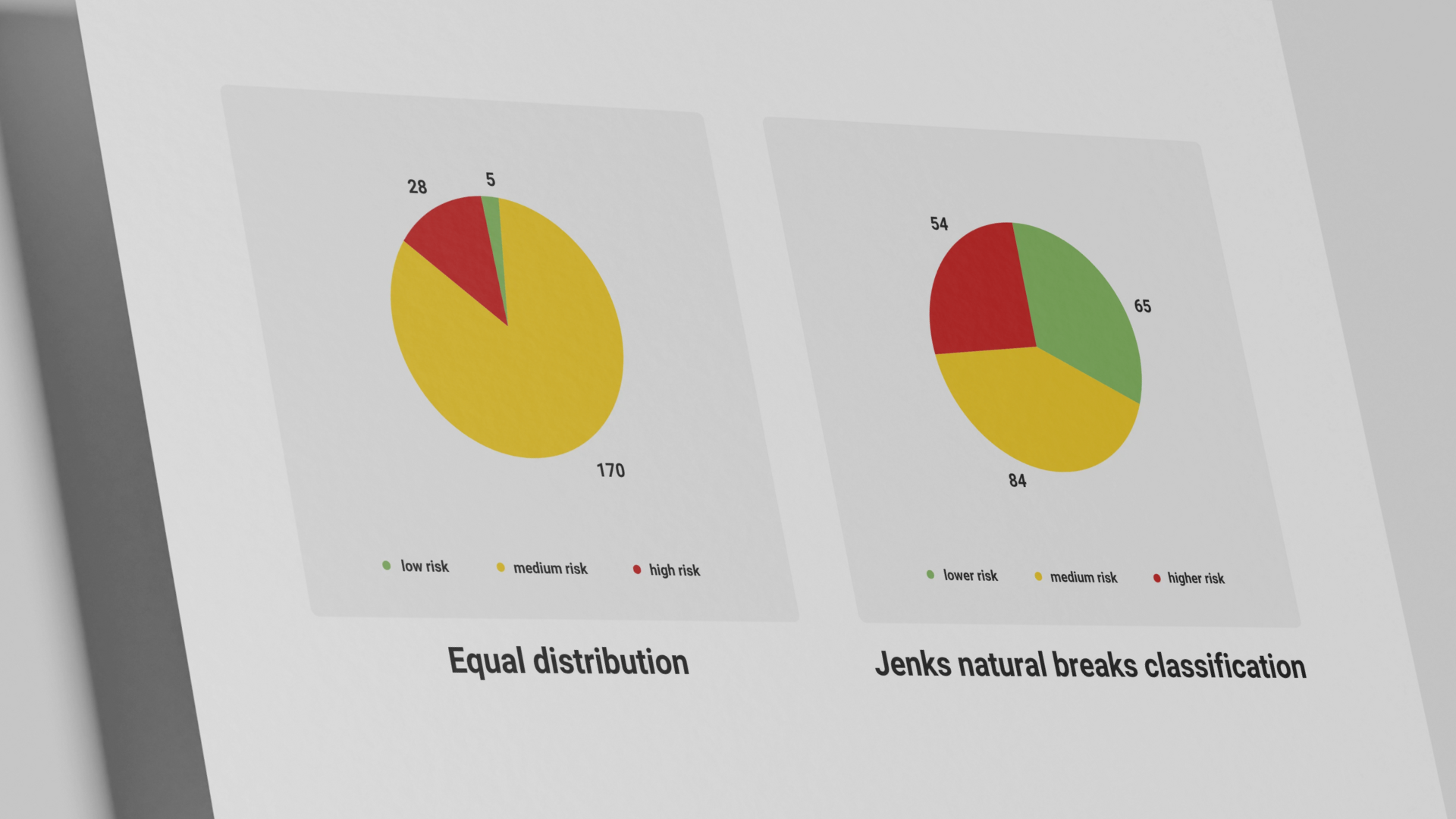

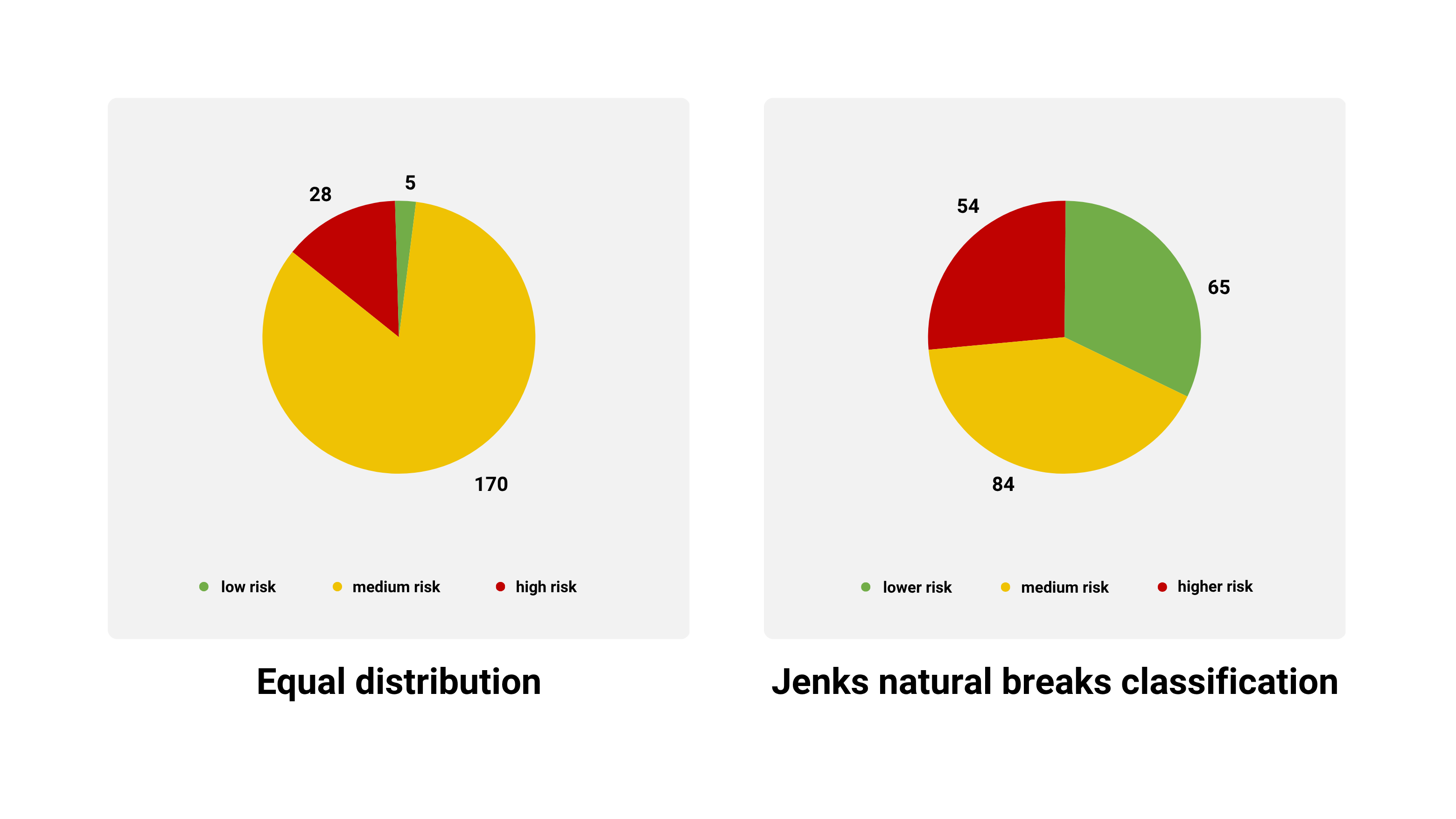

Until now, the Basel AML Index has categorised jurisdictions’ risk levels for Expert Edition subscribers as follows:

- 0–3.3 = low risk

- 3.4–6.6 = medium risk

- 6.7–10 = high risk

This straightforward approach, used not only by the Basel AML Index but also by many other risk-ranking tools, offers stability and simplicity. However, it may no longer capture the granularity needed by financial institutions and policymakers.

Currently, around 84 percent of jurisdictions fall into the medium-risk category, while only 2.6 percent are considered low risk. Another concern is that these uniform thresholds do not fully reflect the actual distribution of data.

Alternative approaches

Several statistical methods were considered during the annual review meeting to achieve a more data-driven classification:

- Standard-deviation-based scoring tailors risk bands to the data’s distribution but assumes a roughly normal shape. This is not fully applicable given the Basel AML Index’s slight positive skew (skew = 0.35).

- K-means clustering also groups similar values but requires equal variance between clusters. This is an assumption not fully compatible with the Index’s weighted structure.

- Jenks natural breaks classification identifies “natural” groupings within the data, minimising internal variance and maximising differences between clusters. This method adapts flexibly to the actual distribution of jurisdiction scores.

Given the characteristics of the data distribution, it was decided to adopt the Jenks natural breaks classification.

What to expect

From the next Public Edition release of the Basel AML Index on 8 December 2025, the Jenks natural breaks classification will be used to highlight risk levels within the three-tier system of the Basel AML Index.

To emphasise that a jurisdiction’s risk is relative to others, experts also agreed to rename the categories “lower” and “higher” instead of “low” and “high”. The final risk-level categories are therefore:

- Lower risk: Less than 4.70 (65 jurisdictions with current data)

- Medium risk: 4.70–6.08 (84 jurisdictions)

- Higher risk: More than 6.08 (54 jurisdictions)

These breaks will remain fixed for the next year. The levels may be reassessed if there are significant changes in data distribution.

Care needed

The new risk-level classification provides a more nuanced picture of AML/CFT risks worldwide. However, any categorisation inevitably simplifies complexities, especially for jurisdictions near category thresholds.

The Basel AML Index applies these risk levels for information purposes only. Detailed data are provided in Excel format for Expert Edition users, who can apply their own categorisations or filter for specific indicators.

We encourage all users – and anyone involved in assessing financial crime risks – to adopt more nuanced ways to identify lower-risk jurisdictions, clients or products, and to refine their application of the risk-based approach.

Additional updates: increased coverage

Due to increased availability of FATF data, the next Public Edition of the Basel AML Index will be able to cover more than a dozen additional jurisdictions compared to the 164 included currently. The broader coverage strengthens the Index’s analytical base while maintaining its commitment to data quality and methodological consistency.

In addition, our Expert Edition Plus subscription – our most comprehensive subscription category, which includes detailed calculative and written analyses of FATF data – will soon cover three further jurisdictions recently assessed by the FATF: Curaçao and Sint Maarten (Kingdom of the Netherlands) as well as the Holy See (Vatican City).

Learn more

- Check out the Basel AML Index and its Expert Edition and Expert Edition Plus subscriptions. Subscription is free for most users outside the public sector – simply sign up and verify your eligibility to view and download detailed data on risk indicators for 203 jurisdictions.

- Sign up for the 2025 Basel AML Index online launch event on 9 December.