Basel AML Index 2025 reveals uneven progress in the global fight against financial crime

The 14th Public Edition of the Basel AML Index shows a world where money laundering risks are levelling out, with improvements in some high-risk countries balanced by declines in traditionally low-risk ones.

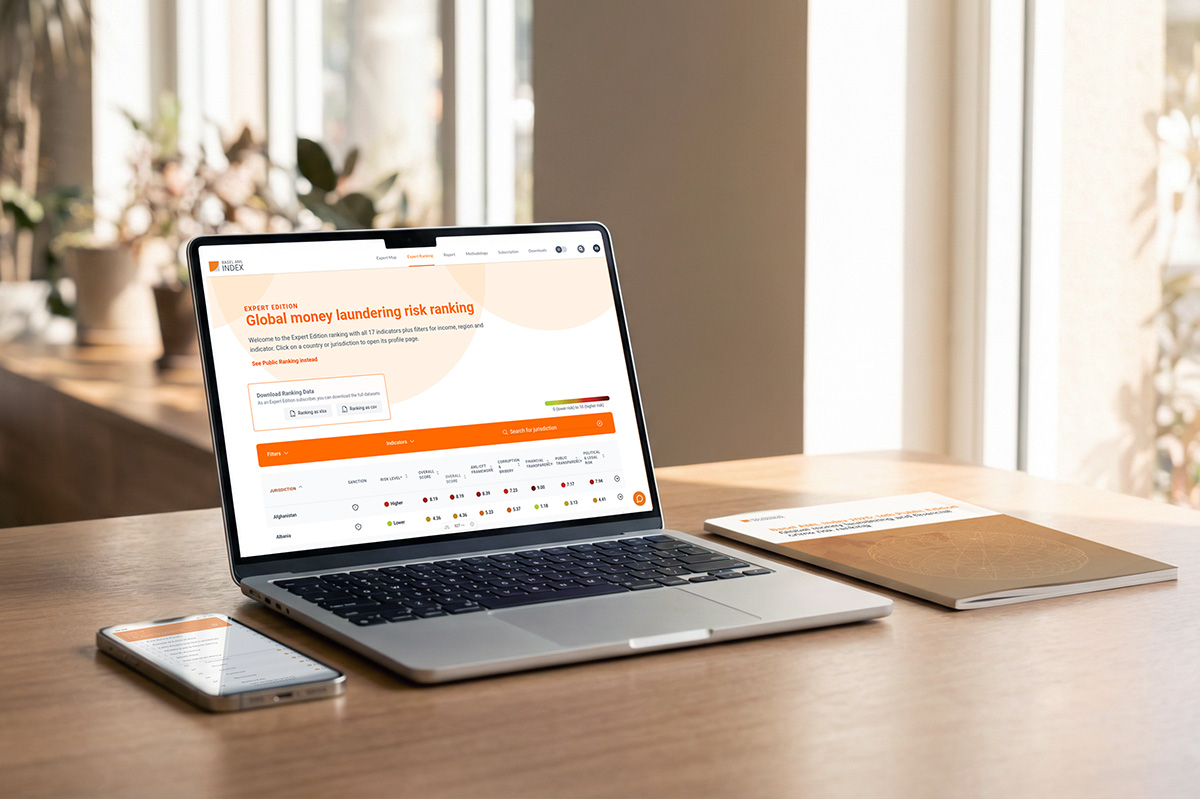

Developed and maintained by the Basel Institute on Governance since 2012, the Basel AML Index is an independent, data-based ranking and risk assessment tool for money laundering and related financial crime risks around the world.

At the heart of the Basel AML Index is a ranking of countries and jurisdictions according to their vulnerability to money laundering and related financial crimes and their capacity to counter these threats. This year, 177 countries are included in the Public Edition. Myanmar, Haiti and the Democratic Republic of the Congo receive the highest risk scores, while Finland, Iceland and San Marino have the lowest.

Key trends

This year’s Basel AML Index report highlights current trends and debates around the fight against financial crime, including:

- The global average Basel AML Index risk score nudged down slightly from 5.30 to 5.28. The shift is statistically insignificant. However, it gives hope that efforts to curb money laundering are not yet being fully overtaken by emerging threats, such as the use of virtual assets and artificial intelligence for crime.

- More than half of jurisdictions improved their scores while 43 percent worsened. The pattern points to a drift towards the middle, as progress in several higher-risk jurisdictions is offset by slippage among long-standing strong performers.

- Results across risk domains are mixed: modest improvements in the quality of anti-money laundering frameworks and small reductions in corruption overall, but weaker financial transparency, rising concerns over public accountability and wide regional variation in political and legal risks.

- Regional trends diverge too. North America, the EU and Western Europe, Eastern Europe and Central Asia, and the Middle East and North Africa all saw higher average risks. Other regions saw slight improvements, most notably Sub-Saharan Africa, with six African countries leaving the Financial Action Task Force grey list and seven among the top ten global improvers.

Emerging challenges

This year’s report includes two deep-dive features examining specific challenges facing anti-financial crime practitioners in both the public and private sectors:

Identifying lower-risk jurisdictions

Though global standards increasingly call for more proportionate use of the risk-based approach to reduce compliance burdens and avoid unintended consequences for financial inclusion, many financial institutions still struggle to assess what constitutes a lower-risk jurisdiction.

The report explains why this remains difficult and how the Expert Edition of the Basel AML Index now applies a more balanced three-part risk categorisation to help users consider their own risk categories and risk appetite.

Assessing risks related to virtual assets

As crypto or virtual assets move from niche to mainstream, understanding their risks has become essential. Yet assessment remains difficult because the ecosystem is largely borderless, only partly regulated and supported by limited data.

The report emphasises that illicit activity involving virtual assets typically exploits the same weaknesses – such as corruption, fraud, weak supervision and poor enforcement – that already undermine the wider financial system. It outlines how users can assess structural vulnerabilities and a jurisdiction’s overall capacity to counter financial crime threats relevant to virtual assets, even without a dedicated virtual assets indicator.

Shining a light

Elizabeth Andersen, Executive Director of the Basel Institute on Governance, comments:

“Tackling money laundering and related financial crimes – crimes like corruption, fraud, environmental crime and drug trafficking that have drastic impacts on people's lives – begins with understanding the risks. That is what the Basel AML Index is for. More than a simple score, it is a tool to explore the factors that underlie a jurisdiction’s risk profile. We hope it continues to guide policymakers and practitioners as they concentrate attention and resources where they can have the most impact.”

About the Basel AML Index

The Basel AML Index is an independent, data-based ranking and risk assessment tool for money laundering and related financial crime risks around the world. It provides risk scores based on data from 17 publicly accessible sources. The risk scores cover five domains relevant to assessing risks of money laundering at the country or jurisdiction level:

- Quality of AML/CFT/CPF framework

- Corruption and fraud

- Financial transparency and standards

- Public transparency and accountability

- Legal and political risks

The Basel AML Index is developed and maintained by the Basel Institute on Governance through its International Centre for Asset Recovery (ICAR). ICAR benefits from core funding from the Governments of Jersey, Liechtenstein, Norway, Switzerland and the UK.

The Basel AML Index has two editions: the annual Public Edition that is the basis for the above report, plus two subscription-based, regularly updated Expert Editions with the full set of risk indicators and more features and analysis. Designed for professionals and policymakers, the Expert Editions are free of charge for public-sector, non-profit, academic and multilateral organisations plus the media.

Learn more

- Visit the Basel AML Index website

- View the launch event on YouTube and download the transcript