Anti-money laundering: what is success?

This article is adapted from the 2024 Basel AML Index public report.

Private companies and governments invest significant resources in efforts to combat money laundering and related financial crimes. Financial institutions alone spent an estimated USD 206 billion globally on anti-money laundering (AML) compliance in 2023 – and that figure is rising. Yet illicit assets continue to flow through and outside of regulated financial systems. Confiscation rates are still very low, with a long way to go before asset recovery becomes an effective deterrence to financially motivated crimes.

This is a disaster for countries deprived of desperately needed funds for development, while also negatively impacting on economies, security and the health of our planet.

It is right to question whether we are on the path to success, and indeed what we mean by success in the fight against money laundering and related financial crimes. This article looks at what data we have and what else we should consider in answering this question.

1 Are we making progress in terms of international standards?

A very basic question is whether countries and regions are at least in line with minimum international standards for AML set by the FATF.

While it is important to question FATF data and standards, and to identify abuses and unintended consequences, ultimately they are the foundation of a harmonised global framework aimed at reducing opportunities for criminals to hide and launder illicit funds.

Technical compliance: fewer black holes on the map

First, the good news. Technical compliance with the FATF’s 40 Recommendations has, on average, increased by 12 percentage points globally since the start of the fourth round of evaluations in 2013. Much of that improvement comes from lower-performing countries catching up with the others. This indicates that more countries are at least meeting basic standards of an AML legal and institutional infrastructure. There are fewer black holes on the map.

To reach the 12 percentage point figure, we analysed data on 113 countries and jurisdictions that had both mutual evaluation reports (MERs) and subsequent follow-up reports (FURs) from the FATF.

The greatest progress has taken place in the area of preventive measures and targeted financial sanctions. The following table indicates the highest level of progress in technical compliance with FATF Recommendations across all 113 jurisdictions assessed with MERs and FURs:

|

Recommendation |

Average technical compliance |

|

R.7: Targeted financial sanctions – proliferation of weapons of mass destruction |

57% (up from 31%) |

|

R.19: Higher-risk countries |

74% (up from 51%) |

|

R.12: Politically exposed persons |

73% (up from 51%) |

|

R.16: Wire transfers |

71% (up from 50%) |

|

R.22: DNFBPs – Customer due diligence |

59% (up from 40%) |

|

R.6: Targeted financial sanctions – terrorism and terrorist financing |

62% (up from 43%) |

It is good to see progress in R.22 on designated non-financial businesses and professions (DNFBPs), since this has traditionally been an area of low performance globally and a frequently criticised weakness in AML systems.

The progress brings hope that more countries have now imposed stricter customer due diligence requirements for gambling businesses, improved record-keeping standards on customer information and transactions, increased the coverage of customer due diligence requirements to relevant professionals such as property developers and precious metal dealers, and increased the responsibilities and obligations for legal professionals.

While improvements in most Recommendations may show real progress across countries, the dynamics in R.16 on wire transfers are complicated by the increase in new payment systems and methods that are not captured by this Recommendation.

In early 2024, the FATF conducted public consultations on possible amendments to R.16 to reflect this evolution in payment systems and to increase the transparency of cross-border payments. It may be that stricter requirements under R.16 will lead to a rapid deterioration in compliance in the next period.

Regional picture: closing the gap

In general, countries and regions with low scores in technical compliance with the FATF Recommendations are catching up, including as a result of being grey listed. The top 20 countries and jurisdictions in terms of progress are mostly in Sub-Saharan Africa and Latin America and the Caribbean, followed by East Asia and Pacific, regions with low average performance previously.

The following table shows countries with the highest level of progress in technical compliance with FATF Recommendations, out of all those assessed with MERs and FURs. Countries with an asterisk (*) are those that are or have been on the FATF grey list.

|

Progress between mutual evaluation report and latest follow-up report |

Countries and jurisdictions (progress in percentage points) |

|

40–52 percentage points |

Mauritius* (52), Botswana* (50), Vanuatu* (49), Mauritania (48), Uganda* (40) |

|

25–39 percentage points |

Pakistan* (33), Iceland* (33), Saint Lucia (29), Bahamas* (28), Sri Lanka* (27), Zimbabwe* (26) |

|

20–25 percentage points |

Mongolia* (24), Kenya* (24), Norway (24), Costa Rica (23), Morocco* (23), Fiji (22), Jamaica* (22), Bhutan (21), Trinidad and Tobago* (21), Tunisia* (20) |

These leaps in performance are not the norm, however: more than half of the assessed countries made progress of less than 10 percentage points.

Effectiveness is falling

More challenging, and more depressing, is to assess changes in effectiveness according to the FATF’s 11 Immediate Outcomes (IOs). FATF follow-up reports do not currently reassess countries against these effectiveness criteria. At the global level, however, we can see that effectiveness is decreasing. And that decrease is happening from an already very low base.

We analysed the difference in global effectiveness scores as the FATF increased its coverage of fourth-round evaluation reports from 115 countries and jurisdictions in 2021 to 178 in 2024.

Average effectiveness dropped from 30 percent in 2021 to 28 percent in 2023 and remained at that low level in 2024. That means newly assessed countries have similarly low levels of effectiveness as those assessed in earlier years.

What’s falling the most? The following table displays the IOs with the lowest effectiveness scores on average across all jurisdictions assessed with mutual evaluation reports. All of them dropped still further between 2021 and 2024:

|

Immediate Outcome (paraphrased) |

Average effectiveness |

|

IO7: Money laundering investigations, prosecutions and effective, proportionate and dissuasive sanctions |

20% (down from 21% in 2021) |

|

IO5: Legal persons and arrangements prevented from misuse for money laundering and terrorist financing (ML/TF); beneficial ownership information available to competent authorities |

21% (down from 22%) |

|

IO4: Financial institutions and DNFBPs apply AML/CFT preventive measures commensurate with their risks and report suspicious transactions |

22% (down from 24%) |

|

IO11: Prevention of financing of proliferation of weapons of mass destruction |

22% (down from 24%) |

|

IO3: Appropriate supervision according to a risk-based approach |

23% (down from 26%) |

|

IO10: Prevention of terrorist financing / abuse of non-profit sector |

24% (down from 27%) |

Even in the IOs with the highest average performance globally across all jurisdictions assessed with MERs, we see decreasing effectiveness as more countries are assessed:

|

Immediate Outcome (paraphrased) |

Average effectiveness |

|

IO2: International cooperation on information, financial intelligence and evidence against criminals and assets |

44% (down from 49% in 2021) |

|

IO1: Risks understood and domestic coordination to combat ML/TF and proliferation financing |

36% (down from 38%) |

|

IO6: Financial intelligence and other information used investigations |

34% (down from 37%) |

|

IO9: Terrorist financing investigations, prosecutions and effective, proportionate and dissuasive sanctions |

33% (down from 37%) |

|

IO8: Proceeds and instrumentalities of crime confiscated |

27% (down from 29%) |

IO8 on proceeds and instrumentalities of crime confiscated dropped despite hopes for a rise, as asset recovery was an FATF priority in 2022–2023.

The big picture? Overall, countries’ AML frameworks are gradually becoming more technical compliant with the global standards but less effective in practice.

Effectiveness along the asset recovery chain

Data from the Basel AML Index Expert Edition Plus, which includes the full FATF dataset, can help to identify weak links in what we call the asset recovery “chain” – all the steps from preventing and detecting illicit financial flows through to their confiscation and restitution.

Applying this concept to FATF data on effectiveness can give us a simplified picture of what might be weak links in the chain. The following figure shows FATF average effectiveness ratings applied to key links in the asset recovery “chain”:

The concept of the asset recovery chain is at the heart of the support provided by our International Centre for Asset Recovery (ICAR) to partner countries, including Basel AML Index-based technical assistance in strengthening understanding of and resilience to money laundering risks.

2 What other data and metrics can we use to better measure success in practice?

FATF data is the best that is available for comparing money laundering vulnerabilities in different countries and jurisdictions, as the same assessment methodology is applied globally.

Yet alone it is clearly not enough to give an accurate picture of success. Critics point out that many countries with high performance in both technical compliance and effectiveness are favoured destinations for those seeking to stash, spend and launder money.

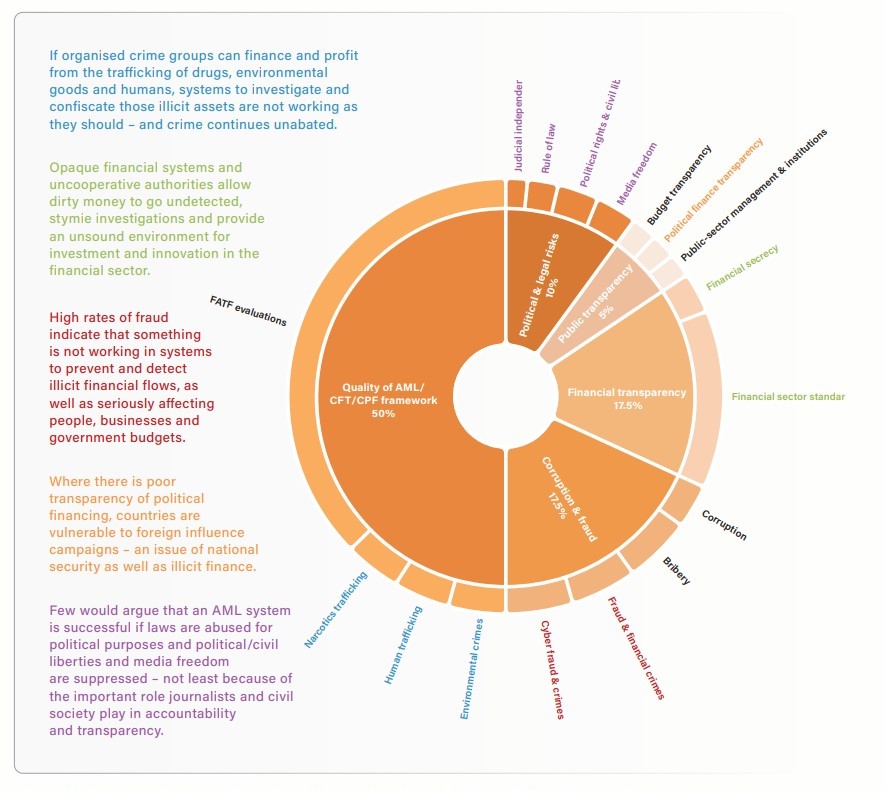

This is why the Basel AML Index methodology takes into account a variety of indicators beyond the quality of a country’s AML framework as assessed by the FATF. They make it easier to evaluate financial crime risk exposure more widely as well as the functioning of the system as a whole. They also make it possible to see where data is missing or could be misleading.

Many of these metrics are useful in evaluating whether systems are working in practice not only to address illicit financial flows as an end in itself but considering wider implications for people and societies.

The following figure offers some illustrative examples. See the methodology online for more information and subscribe to the Expert Edition (free for most users outside the private sector) to view and filter the full data.

3 Clearer goals, better evidence

It may seem obvious to readers, but it still needs to be stressed: the fight against financial crime is not a narrow technical issue but a multi-dimensional challenge that is interlinked with many aspects of our lives at both the national and global level. A single metric alone will never be sufficient to measure success.

Measuring success depends on defining the ultimate objective. The FATF’s purpose has always been to “protect financial systems and the broader economy”. This may be a useful intermediate goal. But we support rising calls to position the fight against money laundering and related financial crimes as ultimately key to achieving a more peaceful, just and sustainable world.

Achieving this ambition requires a nuanced understanding of the broader factors driving money laundering risk and their far-reaching consequences, as illustrated above. It also demands robust evidence of the effectiveness and tangible benefits of AML measures, to counter scepticism and bolster the case for sustained investment in these efforts

Crucially, building an effective AML system is not merely a technical task for a single government department or a compliance team. It is a collective mission that requires collaboration across sectors, industries and borders. Only through a shared commitment and clear vision of our end goal can we create a world where financial systems are resilient to exploitation for criminal purposes and where AML measures support broader societal goals.

Learn more

- Read the 13th annual Public Edition report of the Basel AML Index.

- Explore the Basel AML Index.