Bridging intelligence and investigations: Advanced Operational Analysis training

A major blockage in financial crime cases lies in the space between intelligence and investigations. All too often, crucial financial intelligence from Financial Intelligence Units isn’t used effectively to trigger or advance investigations.

One reason lies in the quality of the financial intelligence reports themselves, which may not match what investigators and prosecutors need. A related reason lies in poor cooperation between different agencies involved in the fight against financial crime.

This blockage is a recurring challenge highlighted in evaluations of the effectiveness of countries’ frameworks for anti-money laundering and counter-financing of terrorism (AML/CFT) conducted by the Financial Action Task Force (FATF). Many countries perform relatively well on Immediate Outcome 6 (IO6), an indicator that measures the effective generation and use of financial intelligence. However, the real difficulty lies in converting this into effective investigations (IO7) and the confiscation of assets (IO8), where scores are consistently lower.

Training to bridge the gap

Advanced Operational Analysis training, which the training team of the Basel Institute’s International Centre for Asset Recovery (ICAR) conducts for government agencies around the world, is specifically designed to bridge this gap.

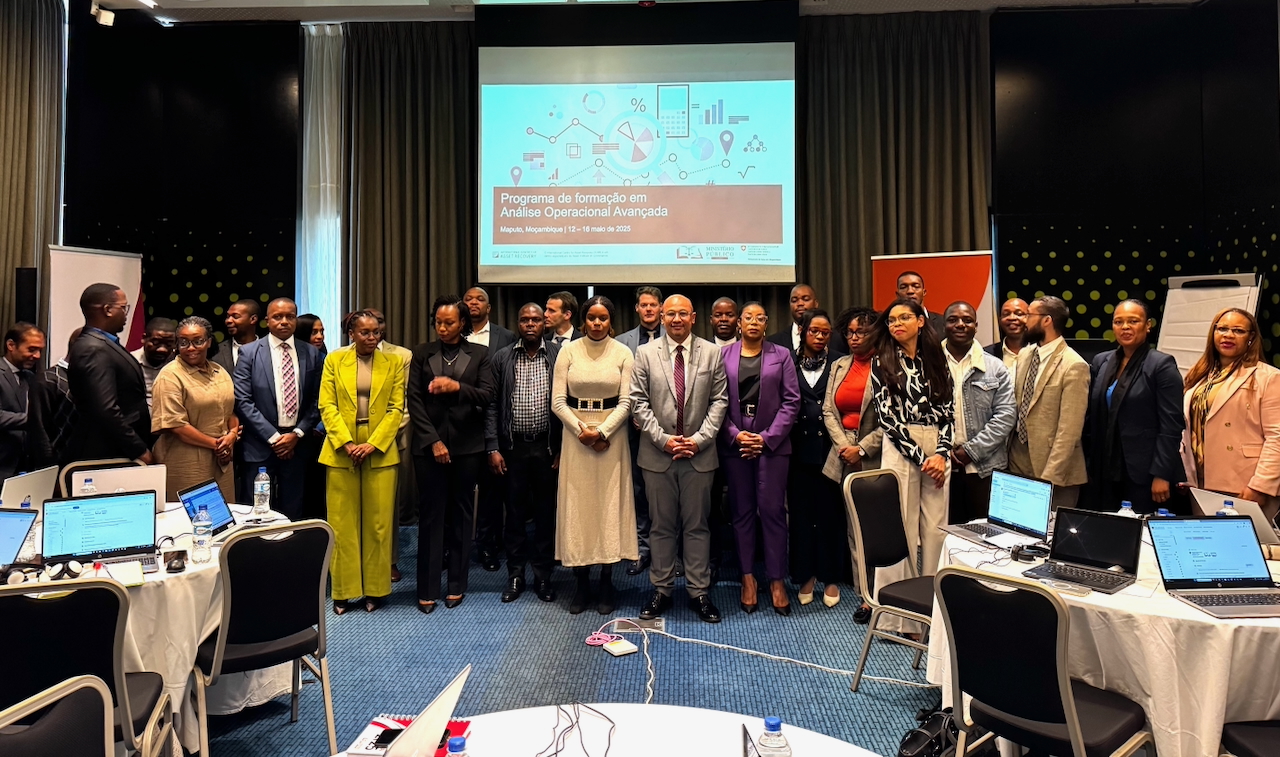

Between May and July 2025, our training team delivered Advanced Operational Analysis training in Mozambique, Ecuador and Tanzania. The intensive week-long workshops brought together Financial Intelligence Unit analysts, investigators, prosecutors and other relevant practitioners in each country.

The objective was to enhance the generation of financial intelligence that officers in investigation and prosecution agencies can act upon. The ultimate goal: successful money laundering investigations and the recovery of illicit assets.

Transforming intelligence into operational leads

The Advanced Operational Analysis training combines our eLearning module on Operational Analysis of Suspicious Transaction Reports with an extensive, instructor-led country-specific component. Participants work through a complex and realistic simulated case involving:

- Shell companies and offshore structures;

- Intricate and large volume of financial data

- Blockchain transactions and the tracing of virtual assets;

- Cross-border elements and international cooperation mechanisms.

They plan and collect relevant information using the intelligence cycle, as outlined in the eLearning course. After analysing it, they present it in a format that helps investigative or prosecutorial authorities identify indicators of possible predicate and money laundering offences as well as proceeds of crime. The authorities must then corroborate this intelligence and convert into evidence. In this way, intelligence is transformed into operational leads.

In Tanzania, participants stressed its immediate relevance:

“The course is very good and relevant to daily work. It helps in analysing financial information and preparing intelligence reports that can be used by investigators and prosecutors.”

“I learned how to collect, process, and present financial intelligence in a way that supports investigations of money laundering and other financial crimes.”

Fostering cooperation between agencies

A key objective of the Advanced Operational Analysis programme is to strengthen cooperation among the diverse actors in the fight against financial crime, from Financial Intelligence Units and prosecutors to law enforcement agencies and even compliance officers from commercial banks.

In Mozambique, participants highlighted the benefits of this joint approach:

“The course allowed us to engage with professionals from other agencies. It helped clarify how different institutions can collaborate and use financial intelligence more effectively.”

Others noted how the practical group exercise mirrored real inter-agency dynamics:

“The methodology, especially the teamwork component, reflects how we should be working in real life — analysts, investigators, and prosecutors together.”

Putting knowledge into practice

Across all three countries, participants described the course as directly applicable. The blend of theory, tools and simulated investigation work gave them the confidence to apply new skills immediately.

One participant in Ecuador reflected:

“The practical case helped us think like investigators and apply analytical techniques in a structured way.”

Participants particularly valued the exposure to diverse methods of gathering and analysing financial data. These elements came together in the simulated case that integrated automated tools such as database and OSINT search, along with AI-powered interview simulations.

By working in a setting that closely mirrored reality, participants were able to visualise how these skills could be applied in their daily work.

Positive signs

The training programmes in Mozambique and Tanzania were delivered as part of the Basel Institute’s country programmes, with support from the Swiss Agency for Development and Cooperation (SDC).

Both countries made significant progress in strengthening the effectiveness of their AML/CFT systems: the FATF confirmed Tanzania’s exit from its grey list of jurisdictions subject to increased monitoring in June 2025, while Mozambique’s Financial Intelligence Unit (GiFIM) joined the Egmont Group of Financial Intelligence Units in July 2025.

Learn more

- View ICAR’s training programmes on financial investigations and asset recovery for government agencies.

- Interested in learning opportunities as an individual? Check out our free eLearning courses and our new advanced study programme with the University of Basel on Combating Financial Crime Through Asset Recovery.

- The Expert Edition Plus service of our Basel AML Index – a widely used country index and risk assessment tool for money laundering and related financial crimes – allows users to view countries’ individual performance under the FATF’s Recommendations and Immediate Outcomes. Subscription is free for public-sector and non-profit organisations.