FATF grey list: truth and myths

This article is adapted from the 2024 Basel AML Index public report.

Financial crime has far-reaching impacts on people’s lives. Yet often the only time it draws serious attention in the media is when a country is added to the FATF’s grey list. This designation of “jurisdictions under increased monitoring” frequently sparks debate and concern, and is clouded by misconceptions. This section looks at five common myths that we come across in our work to support partner countries seeking to avoid or leave the grey list.

Myth 1: The grey list = high-risk countries

A common misconception about the FATF grey list is that it represents (the only) countries and jurisdictions that pose high risks for money laundering, terrorist financing and proliferation financing.

In fact, in the FATF’s own words, the grey list is the public list of jurisdictions that are “actively working with the FATF to address strategic deficiencies in their regimes to counter money laundering, terrorist financing, and proliferation financing.” It is the FATF’s black list that specifically identifies high-risk countries and calls for enhanced due diligence and/or countermeasures when dealing with these.

The distinction is important because not all grey-listed countries pose the same level or type of risk. Many are on a rapid path to improvement. Not all will require enhanced due diligence. And some countries that are not and never have been on the grey list may still present significant risks.

Inclusion on the grey list is based on the FATF's International Co-operation Review Group (ICRG) process and on the criteria summarised under Myth 2, rather than merely on its own criteria for identifying a higher-risk country (see box below).

A complicating factor for financial institutions seeking to identify clear criteria for applying enhanced due diligence is the use of both the black and grey lists by the EU and UK for their own lists of high-risk third countries.

What is a higher-risk country?

The Interpretative Note to the FATF’s Recommendation 10 on customer due diligence sets out guidelines on country or geographic risk factors that might trigger the application of enhanced due diligence according to a risk-based approach. The criteria (note 15b) refer to countries that are “identified by credible sources” as having inadequate AML/CFT systems, high levels of corruption and crime or high levels of terrorist activity and financing, or that are subject to sanctions or similar measures. It does not specifically refer to either the grey list or the black list, though this may be one factor that organisations take into account.

Similarly, Recommendation 19 on higher-risk countries and its Interpretative Note require enhanced due diligence by financial institutions to be applied only to countries “for which this is called for by the FATF”, indicating the black list of jurisdictions subject to a call for action.

Myth 2: Grey listing is a surprise

Each time the FATF holds a plenary session, commentators appear to “bet” which countries will be added or removed. This leads some to believe that grey listing comes as a surprise – even to a country’s authorities.

In fact, grey listing is based mainly on a country’s poor performance in its mutual evaluation report, specifically in one of four criteria:

- Fifteen or more non-compliant or partially compliant ratings for technical compliance in any Recommendation.

- A non-compliant or partially compliant rating for three or more of the following Recommendations: R.3 (money laundering offences), R.5 (terrorist financing offences), R.6 (targeted financial sanctions related to terrorist financing), R.10 (customer due diligence), R.11 (record keeping) and R.20 (reporting of suspicious transactions).

- A low or moderate level of effectiveness for nine or more of the 11 Immediate Outcomes, with a minimum of 2 low ratings.

- A low level of effectiveness for six or more of the 11 Immediate Outcomes.

The authorities typically have a year or more to work on their specific weaknesses without being publicly listed, under the FATF’s International Co-operation process.

The FATF also prioritises countries and jurisdictions with significant financial centres. For the fifth round of evaluations, the threshold has been increased from USD 5 billion to USD 10 billion, measured in broad money terms.

So grey listing is rarely a surprise to the authorities. It is however less easy for third parties like financial institutions and foreign donors to predict whether a jurisdiction will end up on the grey list.

Our Expert Edition Plus now offers subscribers an assessment of the risks that a particular country will end up on the grey list. This makes it possible to better anticipate this and prepare accordingly – including, we would recommend, by using the Basel AML Index to assess the broad range of factors contributing to a higher level of money laundering risk.

Myth 3: Grey listing has only negative impacts

Being added to the FATF grey list can trigger severe economic consequences for countries, especially low-income countries dependent on foreign investment and assistance. Investors and financial institutions may reduce their business in the country. A 2021 IMF paper found that capital inflows decline on average by 7.6 percent of GDP following grey listing, for example.

Financial institutions may also “de-risk” completely – cutting off all business to avoid the extra compliance and risk management costs. Individuals and businesses may have challenges accessing financial services as a result, leading to lower financial inclusion. Other unintended consequences may include an increase in the use of less regulated channels to move money.

Negative economic consequences are not inevitable, however, especially for more developed economies. Croatia’s economy and its financial sector, for example, both appear to be relatively unscathed by its placement on the grey list in 2023. S&P Global even upgraded its long-term sovereign credit rating from BBB+ to A- in September 2023.

Would it have done even better if it hadn’t been grey listed? It is hard to know – but in some cases perhaps being grey listed could even help a country’s performance in the long run, by motivating it to conduct necessary reforms quickly. For example, Iceland and Malta both managed to leave the grey list after just a year, having speedily fulfilled the requirements of their action plans.

For countries receiving development aid, grey listing can bring the benefit of increased targeted assistance to implement reforms and eventually exit the grey list. However, since authorities are typically aware of the risk of grey listing in advance (see Myth 2), it would be more effective if this assistance were provided earlier to help prevent the country from being listed in the first place.

Myth 4: The grey-listing system is inherently unfair

Critics of the grey-listing system point out that it unfairly penalises low-income jurisdictions with less capacity for AML/CFT but also lower significance due to their small financial centres.

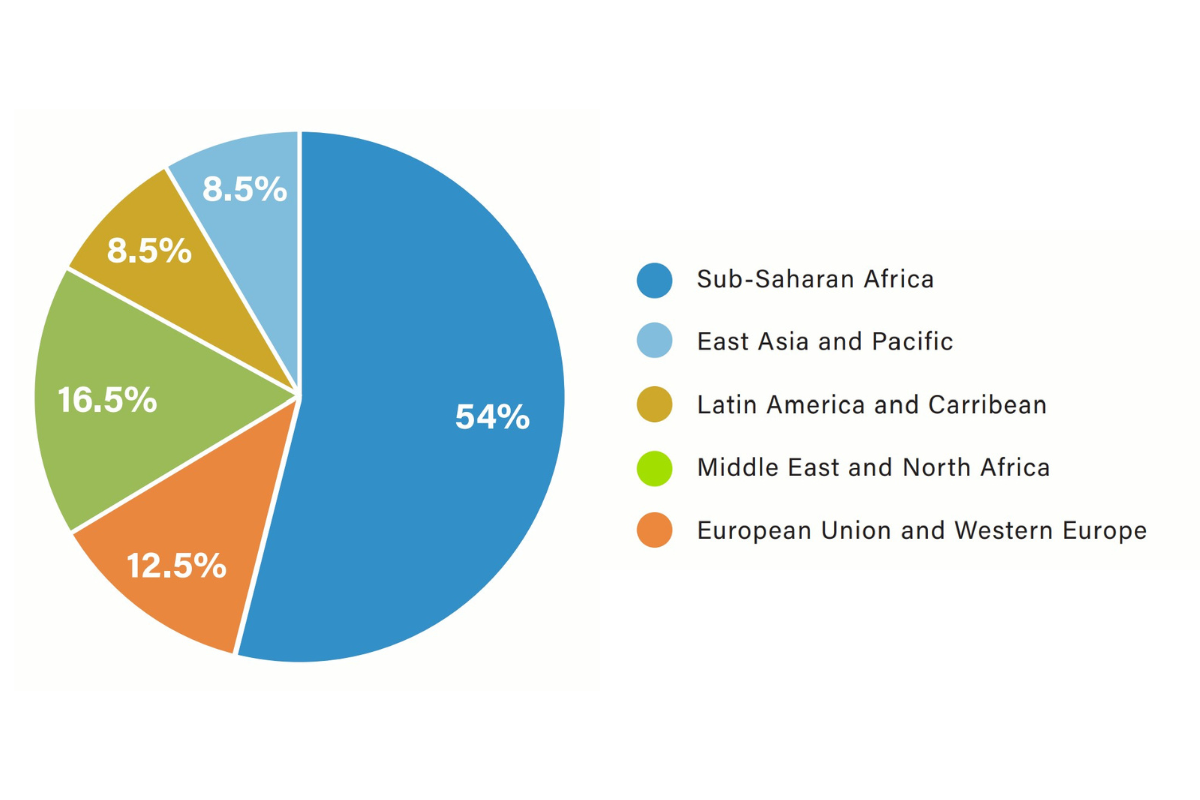

It is true that low-income countries are disproportionately represented on the grey list, but this is changing. More than half of grey-listed countries at the time of writing are in Sub-Saharan Africa, for example. Yet the addition of European countries in 2023 and 2024 – Bulgaria, Croatia and Monaco – shows that the geography is shifting.

The following figure shows the percentage of jurisdictions in each region on the grey list as of October 2024:

New prioritisation criteria announced in October 2024 in effect apply a risk-based approach to grey listing. High-income countries and jurisdictions with financial centres over USD 10 billion will be prioritised. Least developed countries as defined by the UN will not be prioritised except in rare cases of high risk, in which case they will have a longer time period to work on their deficiencies before being grey listed.

As these changes take effect, we should see the grey-listing geography shift towards higher-income countries that are deeply integrated in financial markets.

And there are some simple things that a country can do to avoid grey listing – namely, prepare well for the mutual evaluation process, which is always announced well in advance. Quite basic actions can help, like preparing an up-to-date national risk assessment (and specific sectoral assessments where relevant), gathering statistical data and developing strategies to mitigate identified risks.

The Basel AML Index methodology does not penalise countries for being on the grey list, since the deficiencies that led to them being grey listed are already apparent in the mutual evaluation report data. In 2023, we also updated our methodology to better capture improvements in the effectiveness of jurisdictions that exit the grey list, even if the FATF does not release new effectiveness data.

Myth 5: Leaving the grey list is the end of the story

Grey listing is just one period in a country’s anti-money laundering journey. Being delisted is naturally a cause for celebration and hope, but it’s not the end of the story. Many jurisdictions have been grey listed more than once, including Cambodia, Nicaragua, Panama and Pakistan.

FATF standards continue to evolve and to strengthen, so jurisdictions need to constantly improve in order to keep up.

A prominent example highlighted in several Basel AML Index reports over the years is Recommendation 15 on virtual assets. After it was updated in 2018, almost all subsequently assessed jurisdictions achieved lower levels of compliance than previously. We can expect a similar effect with the updated Recommendations 4 and 38 on asset recovery, where there are still some countries that do not meet basic criteria such as having a non-conviction based forfeiture law or enforcing international judgements based on these laws.

The FATF’s fifth round of evaluations will emphasise effectiveness over technical compliance. Countries will need to put in more effort to improve their effectiveness ratings, which are, on average, less than half as strong as their ratings for technical compliance.

As financial systems continue to evolve, criminals will find ever more ingenious ways to steal, launder and hide money or to use it for illicit purposes such as the financing of terrorism and weapons of mass destruction. Avoiding or graduating from the grey list is one step along a never-ending journey to a resilient system that successfully wards of money laundering and related threats while not limiting financial inclusion and innovation.

Learn more

- Read the 13th annual Public Edition report of the Basel AML Index.

- Explore the Basel AML Index.