Tools to support enhanced due diligence in response to new EU list of high-risk third countries

The European Commission has released a new list of 23 “high-risk third countries” with weak anti-money laundering and counter-terrorist financing (AML/CFT) frameworks.

This means that banks and other entities subject to the EU’s AML rules will have to apply increased due diligence in relation to customers and financial institutions from these countries.

The Basel Institute is dedicated to combating money laundering and other financial crimes around the world. As part of this effort, we have developed two tools to support compliance and due diligence in relation to AML/CFT and financial crime:

Basel AML Index Expert Edition

The Basel Anti-Money Laundering Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing around the world.

The Expert Edition of the Basel AML Index is used worldwide by over 200 financial institutions, policymakers, compliance officers and others to fulfil their regulatory and compliance requirements.

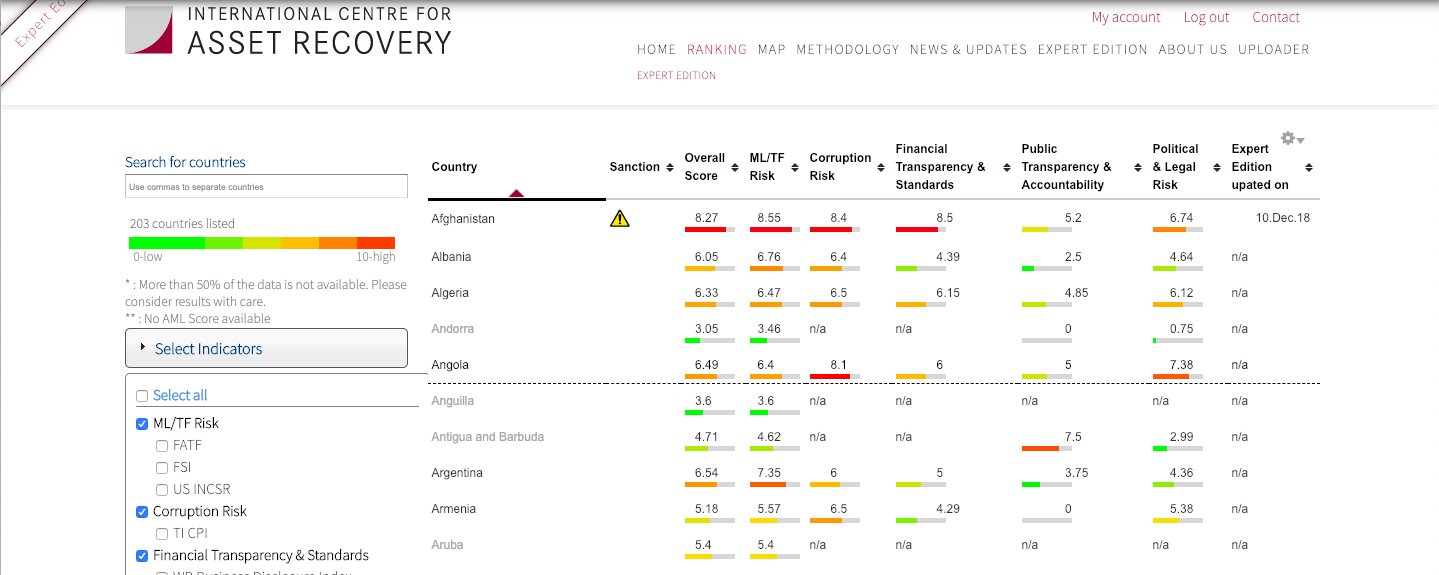

The interactive Expert Edition ranks 203 countries according to their risk of money laundering and terrorist financing. Regularly updated, it includes 14 sub-indicators that help users gain a more detailed understanding of a country’s risk of money laundering and terrorist financing.

The Expert Edition Plus also contains a detailed comparative analysis of the FATF Mutual Evaluation Reports. This allows users to assess each FATF recommendation individually by focusing on specific compliance needs, for example, due diligence or terrorist financing regulations.

For more information and to request a demo account, see the Basel AML Index Expert Edition.

Basel Open Intelligence

Basel Open Intelligence is a powerful new search tool for identifying links between individuals, companies and criminal activities, including money laundering and terrorist financing.

With a single click, it runs multilingual, open-source searches for names in combination with 270 keywords. If there is public information about a person or company’s links to financial crime, law enforcement and judicial actions, Basel Open Intelligence will help find it.

After extensive development and testing during 2018, Basel Open Intelligence is already seeing strong interest from compliance officers and financial institutions as an essential tool for third-party due diligence and risk assessment. The automated search function makes the information-gathering process faster, easier and more effective, saving time and providing greater peace of mind.

For more information and to request a demo account, see Basel Open Intelligence.