Basel AML Index updates methodology to reflect rising global fraud risks

The Basel AML Index – the Basel Institute’s ranking and risk assessment tool for money laundering risks around the world – will include indicators of fraud in its 2024 methodology update.

The changes reflect the growing significance of fraud as a predicate offence to money laundering and as a risk that regulated entities need to consider. Though definitions of fraud vary and data is both poor and inconsistent, the social and economic consequences of fraud make it impossible to ignore in any money laundering risk assessment.

The changes will be implemented in the 13th Public Edition of the Basel AML Index, due to be published on 2 December this year, as well as in the subscription-based Expert Edition and Expert Edition Plus from that point onwards.

Spotlight: fraud on the rise

Statistics from global financial centres (e.g. US, UK, Switzerland, Canada) indicate that fraud is among the top offences reported in suspicious activity reports submitted by banks and other regulated entities.

According to the U.S. 2024 National Money Laundering Risk Assessment, "[f]raud remains the largest and most significant proceed-generating crime for which funds are laundered in or through the United States." Singapore’s 2024 National Risk Assessment likewise identifies fraud – particularly cyber-enabled fraud – as one of the country’s key money laundering threats.

The threat posed by fraud is not just about financial systems, but about its devastating impact on ordinary individuals and companies. Introducing the 2024 INTERPOL Global Financial Fraud Assessment, INTERPOL’s Secretary General referred to an “epidemic in the growth of financial fraud, leading to individuals, often vulnerable people, and companies being defrauded on a massive and global scale”. The assessment highlights the prevalence of investment, romance and advance payment fraud schemes.

Methods used to commit fraud are also becoming more sophisticated and diversified. Technological advancements, including in artificial intelligence and virtual assets, can make (cyber) fraud and the laundering of proceeds easier to commit and more complex to investigate. The FATF, INTERPOL and Egmont Group of Financial Intelligence Units have joined forces on a new initiative to counter illicit financial flows from cyber-enabled fraud, noting its link to other forms of criminality including human trafficking and proliferation financing.

Challenges around definitions and data

Based on discussions with leading financial crime experts at two annual review meetings, we have decided to integrate fraud indicators into the Basel AML Index methodology.

This decision comes with challenges, including:

- the broad and disputed definition and scope of “fraud”;

- the complex, cross-border nature of many forms of fraud and the difficulty in assigning risks to a particular jurisdiction;

- poor data availability, exacerbated by significant underreporting and no global standard.

Other indicators of ML/TF risk related to financial crimes of a cross-border nature face similar challenges. Lack of reliable data and analysis in particular is a major obstacle to countering fraud risks.

Pragmatic approach

The Basel AML Index is primarily a framework for assessing geographic risk, defined as a jurisdiction’s vulnerability to money laundering and related financial crimes and its capacities to counter these threats. and its capacities to counter it. The Index does not attempt to measure the actual amount of money laundering activity.

Therefore we believe it is appropriate for the Basel AML Index methodology to incorporate fraud data with clear caveats and a transparent recognition of the above challenges and weaknesses.

Given the lack of a globally accepted definition, we use the term fraud loosely as an umbrella term for activities that involve deliberate deception of an individual or entity for the sake of obtaining a financial gain. These crimes are often transnational, orchestrated by organised criminal actors and facilitated by technology.

Fraud-related data will be sourced from the Global Organized Crime Index. This source most closely aligns with the Basel AML Index standards on data quality and coverage.

Data will be taken from two categories:

- “Financial crimes”, covering financial fraud, tax evasion, embezzlement and misuse of funds

- “Cyber-dependent crimes”, including malware, hacking, ransomware and cryptocurrency fraud

Both indicators will join indicators of corruption in Domain 2 of the Basel AML Index methodology, with a weighting of 5 percent and 2.5 percent respectively.

Other changes

Three outdated indicators will be removed, bringing the total to 17:

- "Extent of corporate transparency" from the World Bank’s discontinued Doing Business report.

- “Strength of auditing and reporting standards” and “Institutional pillar” from the World Economic Forum’s discontinued Global Competitiveness Report.

Data from the Tax Justice Network’s Financial Secrecy Index will move to Domain 3 on financial transparency and standards. This will enable Basel AML Index Expert Edition users to more clearly separate jurisdictions’ performance on financial transparency from other aspects of their anti-money laundering framework.

Minor adjustments have been made to the weighting to account for the above changes.

Learn more

- Join the online launch event on 4 December 2024.

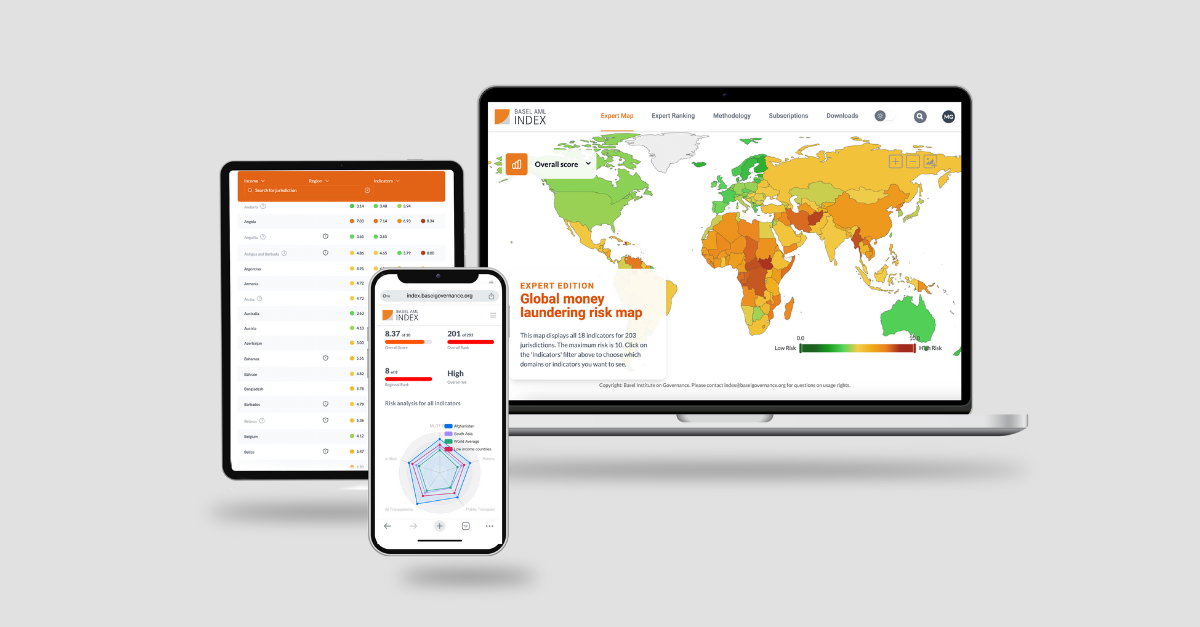

- View the Basel AML Index and its current methodology (prior to the above changes).

- Sign up for the Expert Edition or Expert Edition Plus to explore the current data – it’s free for users from public-sector, non-profit and multilateral entities as well as journalists and academics.