How tax advisers can protect themselves from money laundering risks

Kateryna Boguslavska, Project Manager of the Basel AML Index, spoke at the 12th European Conference on Tax Advisers’ Professional Affairs on 29 November 2019 in Paris. The conference was hosted by CFE Tax Advisers Europe and the Institut des Avocats Conseils Fiscaux (IACF). The presentation aimed to introduce the Basel AML Index Expert Edition as a tool for tax advisers to make their AML efforts more effective.

Tax advisers are Designated Non-Financial Businesses and Professions (DNFBPs). This recognises that, like financial institutions, tax advisers are exposed to risks relating to money laundering.

Tax advisers are therefore, along with independent legal professionals, lawyers and other DNFBPs, subject to anti-money laundering and combating the financing of terrorism (AML/CFT) regulations. Tax evasion is a predicate offence for money laundering.

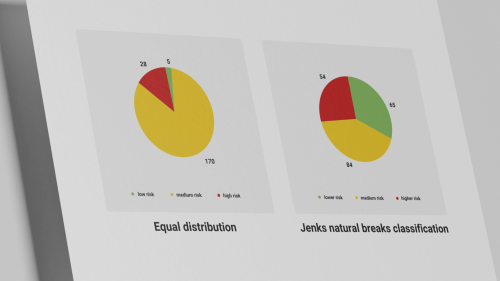

Analysis shows that most countries assessed by the Financial Action Task Force (FATF) for their resilience to money laundering and terrorism financing risks demonstrate only a low or moderate level of compliance with FATF Recommendations R.22 (47% level of compliance), R23 (53%) and R.28 (40%) related to the regulation and supervision of DNFBPs and to customer due diligence obligations. Moreover, according to the FATF assessment of effectiveness, both financial and non-financial sectors demonstrate only 24% compliance in applying preventive AML/CFT measures.

More needs to be done, not only by financial institutions but by the wider financial ecosystem.