Slow progress against dirty money harms people and undermines democracy

A joint blog by Kateryna Boguslavska, Basel Institute on Governance and Maria Nizzero, Royal United Services Institute (RUSI).

Effectively tackling illicit finance and money laundering is crucial to the integrity not only of financial systems, but of democratic societies. And alongside fresh ideas and commitments on fighting financial crimes, we need faster progress on existing ones.

These points are reflected in the latest findings of both the Basel AML Index and RUSI’s Taskforce on a Transatlantic Response to Illicit Finance (TARIF).

The two projects approach the issue of dirty money from different angles. TARIF convened leading illicit finance experts and former policymakers to explore the negative impacts on illicit finance in the US and UK. It focused on the two countries’ vulnerabilities and responses to illicit finance linked to corruption and kleptocracy. It also laid bare the strategic use of illicit finance for malign purposes, and its impact on democracy, security, and financial integrity.

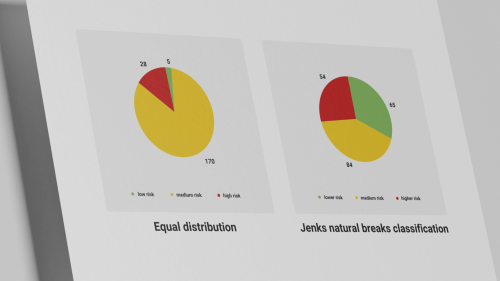

In contrast, the Basel AML Index is a data-based index that calculates countries’ risks of money laundering and terrorist financing (ML/TF). It draws on 18 indicators providing reliable data on countries’ vulnerabilities to ML/TF threats and their capacity to respond. The 11th Public Edition report highlighted trends in global progress against money laundering.

Yet despite the differences, two points stood out in both projects. First, that the fight against illicit finance and money laundering goes beyond protecting the financial system; it is essential to protect ordinary citizens and democratic society. Second, that even though it is often clear what needs to be done, progress is far too slow. As the final TARIF Policy Brief stated:

“Many of the proposed actions and reforms are not new but have been hindered for years by perceived technical or legal barriers. Leaders should support, through resources and rhetoric, an uncompromising drive for solutions with… an acknowledged need to go further than the status quo.”

So what are those actions that need – well, actioning?

Coming clean about risks and vulnerabilities

According to TARIF, key to a transatlantic response to illicit finance is for the US and the UK to come clean about their own deficiencies. Commitments to combat corruption and illicit finance have been made in international fora, such as the FATF, G7, G20 and Summit for Democracy. However, a change in narrative is only the starting point for a plan to tackle kleptocracy to be credible. Concrete actions have to follow.

Similarly, the 11th Basel AML Index report highlighted the importance of a risk-based approach to addressing money laundering. Tackling money laundering starts with a thorough understanding a country’s risks and vulnerabilities, plus a concrete plan to allocate resources efficiently to address the main risks. The Public Edition found that over the last five years, countries have progressed in conducting risk assessments and identifying high-risk jurisdictions. The next step should be the effective implementation of policies and strategies through robust plans based on these risks assessments.

Fixing long-standing issues

In terms of implementing a robust plan, TARIF set out how the US and the UK can practically and effectively strengthen their financial systems, close loopholes and develop safeguards. Many of the recommendations set out in the Policy Brief cover topics discussed in policy forums for years, including enhancing asset recovery, dealing with professional enablers and increasing beneficial ownership transparency.

This year’s Basel AML Index report highlighted many of the same issues, noting that previous reports have continued to flag these over the years. For example, the report noted with concern the growing gap between countries’ technical compliance with international standards and the effectiveness of their efforts in practice.

The data also shows that issues of poor transparency of beneficial ownership, poor progress in the investigation and prosecution of ML/TF offences, and low quality of supervision remain problems for all jurisdictions. The current challenges many jurisdictions are encountering with enforcing sanctions against Russian oligarchs only serve to illustrate problems that have long been present.

Applying standards and aligning goals

The good news is that we don’t need to reinvent the wheel, just make it turn faster. For some of the above challenges, especially those related to addressing money laundering directly, there are well-established standards like the FATF’s 40 Recommendations.

For other aspects, different countries’ approaches may look very different but should ultimately all move towards the same destination. That includes approaches aimed at addressing the strategic use of illicit finance for malign purposes, supporting democracy and enhancing security, including moving from sanctions-based asset freezes to confiscation.

Beyond financial implications

These actions, TARIF stresses, are not only essential to the fight against corruption. They are also necessary to prevent future abuses by kleptocratic actors and their influence, to strengthen democratic societies and both national and international security.

The Basel AML Index also notes that tackling money laundering:

“…is about more than just fighting financial crime. It is about protecting people and the environment.”

Ultimately, effective implementation is the plea at the heart of both reports. Reforms need political will and funding to be successful, whether they are aimed at tackling illicit finance or money laundering specifically. And at the end of the day, it is neither new technology nor blue-sky ideas that will be a gamechanger in the fight against dirty money.

Rather, progress will be driven by the effective application of agreed standards and by good old-fashioned principles – in RUSI’s words, of “honesty, cross-border and cross-sector collaboration, and ambition”.