Basel AML Index 2023: reflecting the progress of grey-listed jurisdictions

The Basel AML Index – the Basel Institute’s global money laundering index and risk assessment tool – will see a small but important methodology update this year. The aim is to better reflect the progress of jurisdictions that have graduated from the so-called grey list of the Financial Action Task Force (FATF), the global standard setter for anti-money laundering and counter financing of terrorism (AML/CFT).

The change will be implemented in the 12th Public Edition of the Basel AML Index, due out on 13 November this year, as well as in the subscription-based Expert Edition from October onwards.

In brief: reflecting improvements in effectiveness

Over the last decade, the FATF has assessed more than 150 jurisdictions on their AML/CFT frameworks using their fourth-round evaluation methodology. The resulting mutual evaluation reports cover the jurisdiction’s technical compliance with the FATF’s 40 Recommendations as well as the effectiveness of their AML/CFT systems according to 11 indicators.

Jurisdictions on the FATF’s grey list are assessed as having “strategic deficiencies” in their AML/CFT frameworks and are therefore placed under “increased monitoring”. To graduate from the list they need to complete a specific action plan agreed with the FATF.

The FATF issues follow-up reports on these jurisdictions’ progress in terms of technical compliance. But follow-up reports are almost always silent about improvements in effectiveness. As a result, many jurisdictions that are removed from the grey list are still rated as having a “low level of effectiveness” in many areas. This does not fairly reflect the efforts these jurisdictions have made to improve their AML/CFT systems and exit the grey list.

To remedy this in the next edition of the Basel AML Index, we will assume that jurisdictions that have graduated from the grey list have improved the effectiveness of their AML/CFT systems to at least a moderate level.

For example, before being placed on the grey list, the Bahamas was assessed as having the lowest score (0) in six of the FATF’s 11 effectiveness criteria. As it was removed from the grey list in 2020, we will assume it has achieved a moderate level (1) of effectiveness in those six criteria.

Does the FATF plan to change this?

Not at the moment. The FATF’s planned fifth-round methodology contains a number of positive changes:

- A shorter evaluation cycle, from around 10 years on average to six years.

- Risk-based prioritisation: high-risk jurisdictions will be evaluated first.

- For non grey-listed jurisdictions, a three-year period to address deficiencies following a mutual evaluation report.

The changes however do not include re-rating of effectiveness levels after graduation from the grey list.

What impact will this have on the Basel AML Index score?

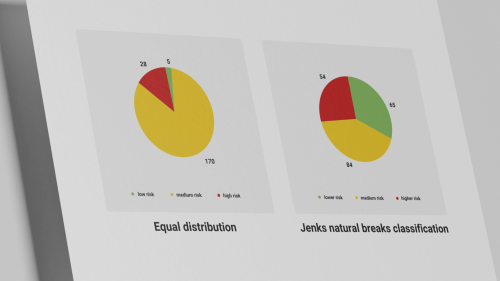

FATF data makes up 35 percent of a jurisdiction’s risk score in the Basel AML Index (see: Methodology). As a result, the change makes a significant difference to countries that have achieved delisting – particularly those with a large number of “0” scores for effectiveness.

For example, Botswana’s FATF data score in the Basel AML Index will improve from 7.4 to 5.58, where 10 equals the highest risk. Ethiopia’s will improve from 7.15 to 5.33 and Pakistan’s from 7.38 to 5.36.

The Basel AML Index overall risk score will adjust in line with the data’s 35 percent weight.

In addition to this adjustment, we will continue to issue individual briefings on the progress of jurisdictions that leave the grey list. Find them on the Basel AML Index website under: Downloads.