OECD blog: new report on responsible business and anti-corruption compliance in Southeast Asia

An illuminating new report by our OECD partners on Responsible Business Conduct and Anti-Corruption Compliance in Southeast Asia illustrates three points we have long emphasised at the Basel Institute.

- First, how corruption, environmental, human rights and other elements of sustainable and responsible business conduct are increasingly being integrated within company-wide risk management frameworks.

- Second, that companies are at very different stages in terms of compliance and risk management – and that's OK. The point is to keep strengthening systems and adapting to new risks, such as those posed by covid-19.

- Third, the huge potential for Collective Action. Companies in the same sectors or geographical areas can help each other close weaknesses in compliance and sustainability risk management systems and thereby raise standards across the board.

Collective Action will feature in the OECD's broader South East Asia Regional Outlook publication, due to be launched at the OECD Global Anti-Corruption and Integrity Forum in the week of 22 March 2021.

Meanwhile, the report's authors Sofia Tirini and Leah Ambler have summarised the main findings in this short guest blog:

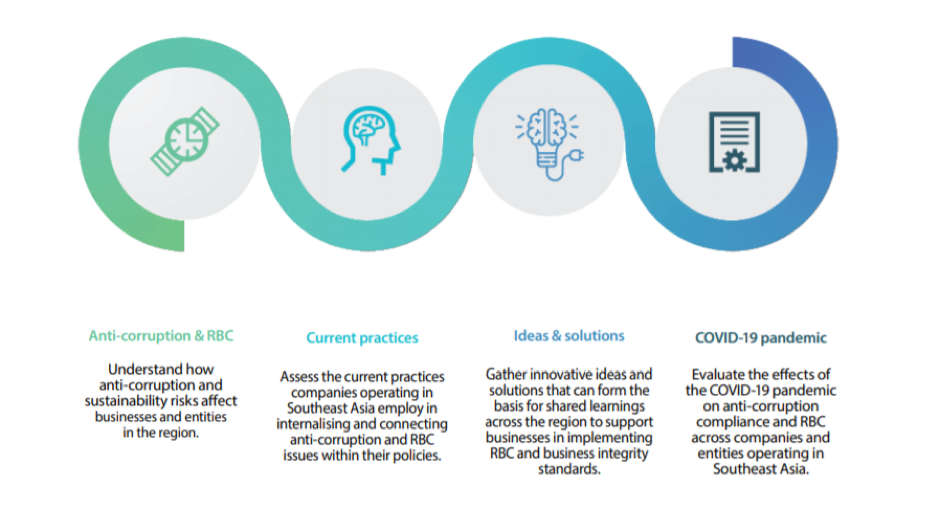

The OECD, in partnership with UNDP, conducted a survey and analysis to better understand how corruption and other sustainability risks affect businesses and entities in Southeast Asia.

The aim of the project was to assess current practices companies operating in the region employ in internalising anti-corruption and business integrity issues within their policies. Additionally, the project sought to evaluate the effects of the covid-19 pandemic on anti-corruption compliance and responsible business conduct (RBC) across businesses and entities operating in the region.

The Responsible Business Conduct and Anti-Corruption Compliance in Southeast Asia provides inputs for recommendations that can form the basis for shared learnings across the region to support businesses in implementing RBC and business integrity standards.

Scope of the survey

Open for a total of five weeks ending on 7th July 2020, and available in six languages, the survey was shared with over 400 potential respondents across 10 countries in Southeast Asia: Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam.

The survey obtained 229 responses, including multinational companies, SOEs and SMEs. The sample was well-distributed across business sizes, ownership type and business functions (production and extraction, manufacturing, services).

The most common sectors were: consulting and professional services, education, consumer goods (manufacturing, sales and distribution), construction and engineering, agriculture and seafood production, energy.

Corruption is the biggest concern

One of the main findings that the survey showed is that being associated with corruption (58%) is the most cited risk that companies face, followed by environmental issues and transparency issues. Association with corruption can be both direct and indirect through contractors, subcontractors and business partners.

In light of these risks, almost all respondents in the sample (95%) have a formal written policy in place setting out expectations for the management of various risks. Those without such policies are overwhelmingly micro-enterprises with fewer than 10 employees.

The most commonly reported risk management policies are for anti-corruption, responsible business conduct and ethics. However, over a third of companies still do not have a policy explicitly addressing corruption within their company. For those companies that extend their policies to contractors, subcontractors and business partners, the majority do not cover anti-corruption. It is nevertheless encouraging to see that many businesses take risk management seriously and have at least the beginnings of a robust set of policies.

Risk management policies

When asked why businesses set up risk management policies or a broader risk management framework, the most common reasons are that:

- it is an obligation under national legislation;

- it is the right thing to do for people, the planet and society;

- to address the risk of reputational damage.

National legislation or guidance seems to have the greatest influence on business risk management policies. Doing the “right thing” and avoiding reputational damage are also important factors. All this points to an already established track-record of awareness and engagement with business risks, especially corruption, even if much of the sample is made up of businesses already exposed to the OECD’s efforts in these areas.

The pandemic effect

Considering the survey was conducted between May and July 2020, when Southeast Asian countries were in various stages of “lockdown” due to the covid-19 pandemic, it is possible that the context may have shifted their vision and priorities regarding business risks.

Although over half of respondents reported increased environmental, social and/or governance risks during the crisis, only a third are planning to make changes to their business integrity and/or RBC framework to reduce the impact of covid-19. An additional quarter of respondents report that they are unsure whether they will be making changes.

Upcoming report: South East Asia Regional Outlook

A larger version of the report will be published by the OECD containing more interesting findings on anti-corruption risks and challenges in South East Asia. In this broader publication, the OECD will provide information on other issues such as gender policies, risk areas for businesses and the impact of technology among others.

The “South East Asia Regional Outlook” is expected to be launched in 2021 in the framework of the Global Anti-Corruption and Integrity Forum.