How effective are jurisdictions at preventing money laundering? Insights from the 10th Basel AML Index

Why do so many jurisdictions score so poorly for the effectiveness of their anti-money laundering systems? What's the biggest problem - prevention or enforcement? Answer from our Basel AML Index 2021 report: Ineffective systems are the general rule, but jurisdictions consistently score worse for prevention than for enforcement. Excerpt:

Last year in our 2020 Basel AML Index we lamented jurisdictions’ consistently poor results in terms of the effectiveness of their anti-money laundering and counter financing of terrorism (AML/CFT) systems. It is all too common for jurisdictions to have laws and institutions in place that are largely compliant with FATF Recommendations yet ineffective in practice.

The Wolfsberg Group, a Collective Action initiative of 13 global banks that develops frameworks and guidance on financial crime risks, reinforced our concerns in a June 2021 statement on Demonstrating Effectiveness:

“[L]argely in response to supervisory expectations, AML/CFT risk assessments are focused on technical compliance with requirements rather than the effectiveness of the [financial institution’s] efforts to prevent and detect financial crime”.

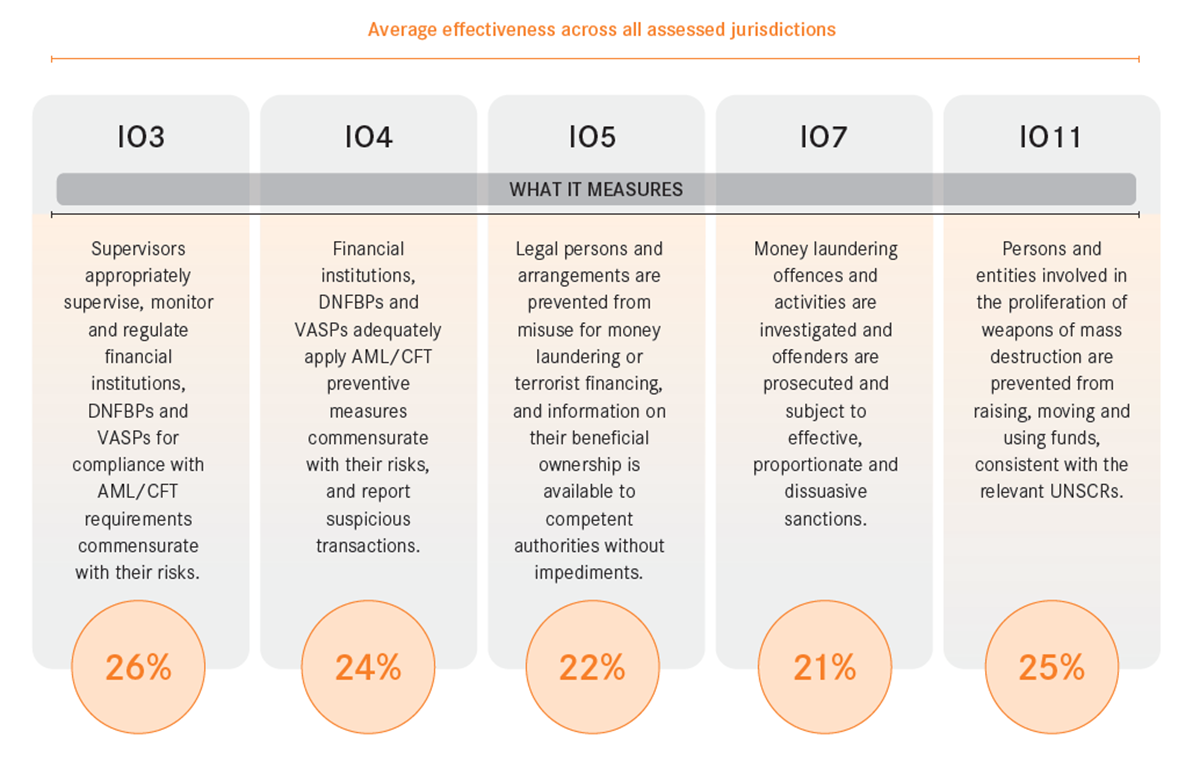

Data on the effectiveness of AML/CFT systems is drawn from Financial Action Task Force (FATF) Mutual Evaluation Reports. The FATF uses 11 “Immediate Outcomes” (IOs) to assess the effectiveness of AML/CFT systems according to its 40 Recommendations.

The 11 IOs and the assessment methodology are detailed on the FATF website.

Is there any sign of improvement in the figures for 2021?

Not really. Based on the latest FATF data, the average score for effectiveness across all assessed jurisdictions is only 30%. That is two times lower than the average score for technical compliance with FATF Recommendations, which stands at 64%.

Weak spots vary between jurisdictions, but overall they are as shown in the chart below:

Are jurisdictions doing better at prevention or enforcement?

Ideally, AML/CFT systems need to be particularly effective at preventing money laundering from occurring. Enforcement remains of course important, and it must be effective. But relying too heavily on catching the criminals post factum presents an unreasonable risk and also means that some damage invariably will remain.

So we should be asking if jurisdictions doing enough on the prevention side, or if they are too heavily focused on enforcement. To explore this question, we divided FATF data on effectiveness criteria (IOs, see chart above) into two categories:

| Prevention | Enforcement |

|---|---|

| IO1: Risk, policy and coordination | IO7: Money laundering investigation and prosecution |

| IO3: Supervision | IO8: Confiscation |

| IO4: Preventive measures | IO9: Terrorist financing investigation and prosecution |

| IO5: Legal persons and arrangements | IO6: Financial intelligence (mainly enforcement) |

| IO10: Terrorist financing preventive measures (mainly prevention) |

*Note that IO2 is not included as it refers to elements of both prevention and enforcement, while IO11 is not relevant to the topic.

Based on an analysis of 112 jurisdictions assessed with the FATF's latest (fourth-round) methodology by 15 July 2021, the data shows that jurisdictions are less effective at preventing ML/TF than at enforcing AML/CFT measures. And this is in a context where performance for enforcement is unsatisfactory already.

- Globally, average effectiveness for prevention was 27%, compared to 31% for enforcement.

- Nineteen jurisdictions (17%) scored zero for the effectiveness of their preventive measures, compared to 12 jurisdictions (11%) for enforcement.

- Nine jurisdictions demonstrated zero effectiveness in both prevention and enforcement criteria. These are: Cape Verde, Democratic Republic of the Congo, Haiti, Mali, Mauritania, Mozambique, Pakistan, Uganda and Vanuatu.

- The UK and Spain are the only jurisdictions assessed so far to achieve scores of 67% or above for both prevention and effectiveness criteria.

A regional perspective shows some variation, but the same overall story: When it comes to money laundering, jurisdictions seem to be more effective at enforcement than prevention.

| Region | Prevention average | Enforcement average |

|---|---|---|

| East Asia and Pacific | 26% | 32% |

| Eastern Europe and Central Asia | 37% | 38% |

| Latin America and Caribbean | 25% | 26% |

| Middle East and Northern Africa | 32% | 40% |

| North America | 53% | 56% |

| South Asia | 7% | 13% |

| Sub-Saharan Africa | 5% | 8% |

| Western Europe and EU | 37% | 43% |

That being said, it is a well known fact that measuring effectiveness in prevention is considerably more difficult than measuring effectiveness at enforcement, for which data and statistics are often available from law enforcement and judicial actions.

So what?

These findings should ring an alarm bell for policy makers. Jurisdictions should invest more resources in the prevention of ML/TF, because a fire contained is always better than an arsonist caught when the house has burnt down. Although of course, the arsonists must also be caught and punished.

We are far from arguing that such an increase of resources for prevention should come at the detriment of enforcement. On the contrary, both sides clearly need a serious boost, except perhaps the boost for prevention needs to be even more serious than that for enforcement.

More from the Basel AML Index

- Find out about the Basel AML Index, view the latest Public ranking and find out whether your organisation is eligible for a free Expert Edition account at our brand new website: index.baselgovernance.org.

- See the Basel AML Index 2021 press release.