Basel AML Index 2019: Too little progress – are AML systems effective?

Falling rankings in the Basel AML Index, released today, show how many countries’ AML systems are a weak defence against today’s money laundering risks.

Ineffective anti-money laundering and counter financing of terrorism (AML/CFT) systems and lack of transparency are leaving the door open to increasingly sophisticated money laundering schemes.

These are two findings of the 8th edition of the Basel AML Index, an independent, research-based ranking that assesses countries' risk exposure to money laundering and terrorist financing (ML/TF). They may help to explain why countries generally considered “safe” for investment have been hitting headlines recently with high-profile money laundering scandals.

Quality of AML/CFT framework

Colombia, Latvia, Finland, China and Lithuania fell significantly in this year’s Basel AML Index rankings due to poor assessments of the effectiveness of their AML/CFT systems by global money laundering watchdog, the Financial Action Task Force (FATF).

FATF evaluations, which since 2013 assess not just technical compliance of anti-money laundering systems but their effectiveness, are a key indicator in the Basel AML Index.

Findings suggest that compliance and effectiveness often do not go hand in hand. Vanuatu’s AML/CFT system, for example, scores highly for technical compliance but 0% for effectiveness.

Gretta Fenner, Managing Director of the Basel Institute on Governance, which issues the annual ranking, says:

“It’s like the car emissions scandal, but for illegal money. Preventive systems may be in place, but too often they’re not doing what they’re supposed do. Governments who are really serious about combating financial crime should get in the driver’s seat and start fixing the weaknesses that FATF assessments reveal. Countries benefit far more from being seen as a trustworthy, low-risk location for investment than by letting the dirty money of criminals flow through the loopholes.”

This is a wake-up call. When it comes to AML/CFT systems, countries need to focus on effectiveness and not just tick-box compliance.

Corruption and bribery

Denmark is rated the least risky country for corruption and bribery, followed by New Zealand and Singapore in a list of top 10 performers dominated by Nordic and northern European countries. This risk category draws on Transparency International’s Corruption Perceptions Index and the TRACE Bribery Risk Matrix, which was newly added to the Basel AML Index this year as an indicator of business bribery risk.

The correlation between corruption and money laundering must be considered by governments when they seek to make their AML systems more effective.

Financial transparency and standards

Offshore financial centres such as the Marshall Islands and Caribbean islands of Grenada and St. Lucia are among the lowest-performing countries in terms of financial transparency and standards. On a more positive note, some larger financial centres such as Switzerland and the UK have improved their scores in this category since 2018. Financial secrecy is considered a major risk for ML/TF activity.

Analysis of FATF data reveals disappointing efforts to improve transparency of beneficial ownership, despite the attention this issue has attracted in recent years. The average score for technical compliance in this category is only just over 40%. The situation is even worse when it comes to the average effectiveness score, which is only 23%.

Information on ownership structures is largely unavailable to competent authorities, adding unnecessary hurdles to effective enforcement of laws on money laundering and related financial crimes.

Public transparency and accountability

Poor performance in public transparency is mainly associated with political party and election campaign financing, as well as budgetary transparency and accountability. Countries as diverse as Vanuatu, Switzerland, Gambia and Qatar feature on the list of 10 poorest performers.

Could there be room for more streamlined international rules?

Legal and political risks

The list of top 10 performers in terms of legal and political risks – covering media freedom and the strength of the rule of law – is again dominated by Nordic and northern European countries, plus New Zealand and Canada.

Countries destabilised by war, with weak rule of law and where members of the press are stifled, are easily abused by criminals. This year’s list of poor performers in this category is led by Yemen and Venezuela.

For a full overview of results, analysis and interactive country comparison tables, plus the opportunity to demo the Expert Edition, visit the Basel AML Index website: index.baselgovernance.org.

About the Basel AML Index

The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing (ML/TF) around the world.

Published by the Basel Institute on Governance since 2012, it provides risk scores based on data from 15 publicly available sources such as the Financial Action Task Force (FATF), Transparency International, the World Bank and the World Economic Forum. The risk scores cover five domains:

- Quality of ML/TF Framework

- Bribery and Corruption

- Financial Transparency and Standards

- Public Transparency and Accountability

- Legal and Political Risks

The Public Edition of the Basel AML Index 2019 covers 125 countries with sufficient data to calculate a reliable ML/TF risk score.

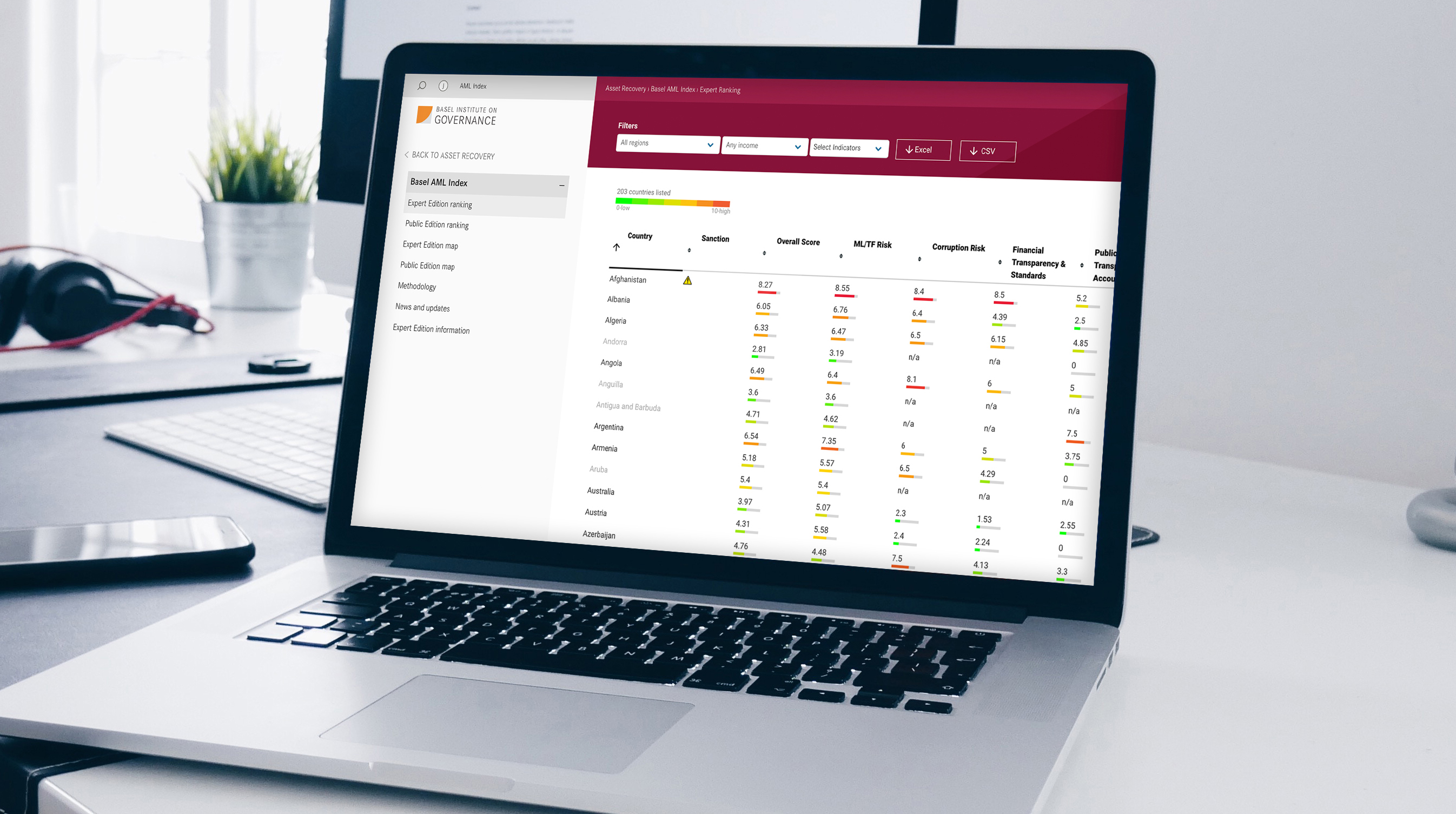

A comprehensive list of scores and sub-indicators for 203 countries is available in the Expert Edition, a subscription-based service used by companies and financial institutions as an ML/TF country risk-rating tool for compliance and risk assessment purposes. Subscription is free for academic, public, supervisory and non-profit organisations.

Additional services and resources this year include an upgraded, in-depth analysis of FATF Mutual Evaluation Reports and a detailed analysis of ML/TF risks in post-Soviet countries.

Downloads

- Press release (English)

- Comunicado de prensa (Español)

- Press release (Russian)

- 2019 report including ranking

Contacts

- Technical or country-specific enquiries: Basel AML Index Project Manager, Kateryna Boguslavska

- Media enquiries and requests for interview: Communications Officer: Monica Guy

- Subscriptions: via the website or email index@baselgovernance.org