AML supervision and financial scandals – what the Basel AML Index and FATF data reveal

Our recently released 9th Basel AML Index reveals – disappointingly – that global money laundering risks remain high. The average risk score across all 141 countries in the Public Edition this year is 5.22, compared to 5.39 in 2019.

Few countries are making dramatic progress in addressing these risks. In fact, only six countries improved their risk scores by more than one point. 35 countries went backwards.

Of course, major shifts in global risk patterns cannot be expected from one year to another. What’s interesting, when a phenomenon is stagnant like this, is to really drill deeper into the underlying causes. One area in which countries score poorly across the board is the quality of AML/CFT supervision.

Supervision: why so poor?

Supervision by competent authorities of financial institutions, designated non-financial businesses and professions (DNFBPs) and virtual asset service providers (VASPs) is a major factor affecting AML/CFT risk and resilience. This poor performance is consistent with breaches of AML provisions in European banks over the last few years, as well as with the recent Wirecard scandal in Germany, which have raised alarm about the quality of banking and non-banking supervision related to AML/CFT.

What is wrong, and what can be done to improve supervision generally?

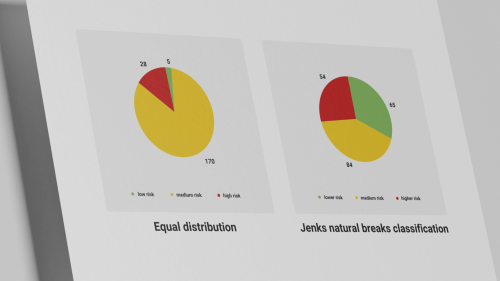

Supervision is very much at the intersection between regulation and implementation, i.e. technical compliance with AML/CFT standards and their enforcement. Looking at data from FATF 4th-round evaluation reports, we see that while countries generally have low or mediocre scores for technical compliance, the most problematic issue is with the effectiveness of their measures.

- In terms of technical compliance, the average score for standards of regulation and supervision of financial institutions (R26) is only 57%. It is even lower for DNFBPs (R28), at 42%.

- The average effectiveness of these measures and their implementation (IO3), however, lies even lower at 26%. A full 32 countries score zero in this category, and not a single country gets full marks.

Improving banking and non-banking supervision is therefore an obvious and clearly much needed way to strengthen AML/CFT systems worldwide. This may be through corrective measures and proportionate sanctions that help to change behaviours and deter non-compliance.

What factors contribute to ineffective supervision?

A content analysis of FATF Mutual Evaluation Reports from the 32 countries with an effectiveness rating of 0% for AML/CFT supervision identifies five general characteristics:

- Limited powers to sanction non-compliance by civil or administrative means. This leaves only criminal prosecution, for which the bar is typically high.

- Limited resources including qualified staff, processes, IT systems and tools.

- Risk-based approach is not applied, meaning supervision is not commensurate with the risks and the size of the financial centre and the number and intensity of reviews are not aligned with existing risks.

- Poor coordination between competent authorities on supervision, with individual agencies focused only on their sectors.

- Insufficient guidance on ML/TF risks provided by supervisory body to reporting entities.

This analysis is based on FATF data for 100 countries assessed with the fourth-round evaluation methodology, which covers both the technical compliance and effectiveness of countries’ AML /CFT systems. The research covers FATF indicators relevant to supervision: R26, 27, 28, 34 and 35, plus IO3.

More information

- For case studies of financial supervision in Denmark and Spain, infographics/charts and more detail on AML supervision issues, please see section 4 of the Basel AML Index 2020 report.

- Find out about the Expert Edition interactive risk assessment tool and Expert Edition Plus, which includes a regular detailed analysis of FATF data.

- See the FATF's Guidance for a risk-based approach: effective supervision and enforcement by AML/CFT supervisors of the financial sector and law enforcement.