Three things countries and companies must do to address illegal financial flows from environmental crimes

Three critical imperatives to tackle the hundreds of billions in illegal funds flowing annually from environmental crimes arose from the latest OECD-Basel Institute virtual dialogue on 17 March.

- First, proper assessments of financial crime risks arising from environmental crimes, by governments and the private sector.

- Second, more proactive cooperation across sectors and countries, through public-private partnerships and similar mechanisms.

- Third, applying good ideas and effective tools from other areas of financial crime-fighting to the challenge of environmental crime.

Most of all, everyone everywhere dealing with financial services, crime and risk needs to start working proactively together, because the challenge is tremendous. By many estimates, illegal financial flows from environmental crime surpass those of other serious and organised crimes like drugs, arms and human trafficking, which are often committed by the same actors.

Yes, it is a complex and fluid topic. Compared to other crimes there is less information and more grey areas where legal and illegal activity merge. Yes, there are hurdles, like differences in national laws on predicate offences and data protection. But the panellists, representing the views of both the public and the private sectors, were clear: these are not an excuse to wait and watch.

Environmental crime remains a top priority of the FATF under the current German presidency, broadening the scope from an initial focus on illegal wildlife trade (IWT) under the 2019 Chinese presidency. The risks that environmental crime poses to sustainable development everywhere are also recognised by the G7 and will only become more critical as the planet warms and biodiversity degrades. And the G20 likewise has long highlighted the role that corruption plays in facilitating the illegal trade in wildlife and wildlife products.

National risk assessments – a fundamental first step

The first imperative is for both the public and private sectors to properly assess financial crime risks arising from environmental crimes. This starts with incorporating the multi-faceted risks of environmental crimes in national risk assessments, which is still only rarely done. In light of many competing priorities, environmental crimes will otherwise inevitably drop down the priority lists of financial intelligence units (FIUs) and financial institutions, or even off the radars.

In Malawi, the inclusion of IWT in the national risk assessment in 2018 unlocked the ability for the Financial Intelligence Authority (FIA) to launch systematic efforts to address illegal funds from such crimes. The assessment revealed that, in fact, IWT was one of the most proceeds-generating crimes in the country. Coupled with new investigative powers and efforts to build relationships and awareness among stakeholders including law enforcement, the Department of National Parks and Wildlife and supporting NGOs, Malawi’s FIA has become a leader in the fight against IWT.

Lessons learned? FIUs may need to push proactively for environmental crimes to be included in the national risk assessment. Then, analysts need specialised training in what is, for many, a new field and particularly challenging in economies where hard-to-trace cash is king. Governments need to provide a clear division of powers and responsibilities among authorities on environmental crimes.

The other major need for FIUs is cooperation with the private sector. Here the question is: how are financial institutions working to understand and address risks related to environmental crimes?

Supporting a risk-based approach in the private sector

The answer: with some exceptions, not yet very well. In a recent ACAMS Compliance Effectiveness and Risks Survey, only a quarter of participating compliance professionals said their institutions were ready to flag transactions potentially linked to wildlife trafficking and other environmental crimes.

South Africa-based Absa Group is one financial institution that is developing sophisticated data analysis, transaction monitoring and customer due diligence systems to assess and address its exposure to environmental crime-related risks. This needs high-quality intelligence on local risks related to geography, industry sectors, and customer typologies and activity. Though still in its early stages, the United for Wildlife Financial Taskforce has been crucial in collating and providing this intelligence (including through a monthly intelligence bulletin) as well as facilitating cooperation and knowledge-sharing regionally, internationally and across sectors.

While the client risk profiles in (typically) source countries such as South Africa or Malawi look very different to those in financial centres such as Switzerland and Liechtenstein, there is a lot that financial sector actors at different stages of the value chain can still learn from one another.

Public-private partnerships for proactive cooperation

This is why cooperation is essential, both among the private sector and between the public and private sectors, to galvanize the potential inherent in the work of all parties who are on the right side of the fight against environmental crime.

FIUs have significant analytical capabilities, as well as access to data and informal cooperation, that are currently underutilised to address environmental crime. The Egmont Group is supporting capacity building and cooperation within FIUs on environmental crimes, including through a recent report, workshops and eLearning. But without proper platforms for public-private cooperation, these efforts will achieve too little.

Why? Partly because financial institutions and other reporting entities need support and intelligence to help identify suspicious transactions relating to environmental crimes. Partly also as they are sitting on information that can be vital for law enforcement, such as mobile phone numbers that can be used to trace mobile money payments and geolocate suspects.

Public-private partnerships can also bring in the expertise and knowledge of other actors, from lawyers and accountants to logging or mining companies and NGOs. And they are a proven way to overcome legal barriers to information-sharing. In South Africa, for example, the South Africa Integrated Money Laundering Task Force (SAMLIT) provides a legal platform for information-sharing among financial institutions and has launched a working group on IWT that integrates the United for Wildlife Financial Taskforce.

Countries have a responsibility to set up and support such mechanisms, which have the potential to transform individual efforts to address illegal funds from environmental crimes into coordinated and effective action.

What can we learn from other finance-focused partnerships?

Finance Against Slavery and Trafficking (FAST), a multi-stakeholder collaboration arising from the Liechtenstein Initiative, has had a transformational effect on financial sector action against modern slavery and human trafficking that can serve as inspiration and a source of practical ideas. The latest report, Unlocking Potential: A Blueprint for Mobilizing Finance Against Slavery and Trafficking, contains five goals and an implementation toolkit through which financial sector actors can work to achieve them through individual and collective action.

There are many parallels between human trafficking and environmental crime, and much potential for mutual learning from the frameworks, tools and experiences. What could we learn from Brazil’s experience in establishing a public “dirty list” of citizens and companies caught benefitting from modern slavery? On the policy and regulatory side, experience shows that individual and collective action by the private sector needs support from regulators to push the industry forward and maintain a level playing field.

In sum: we all need to better understand our risks and better cooperate to address them, taking inspiration and motivation from the initiatives that work. For more inspiration, watch the full event on YouTube and learn more about Green Corruption.

About the event

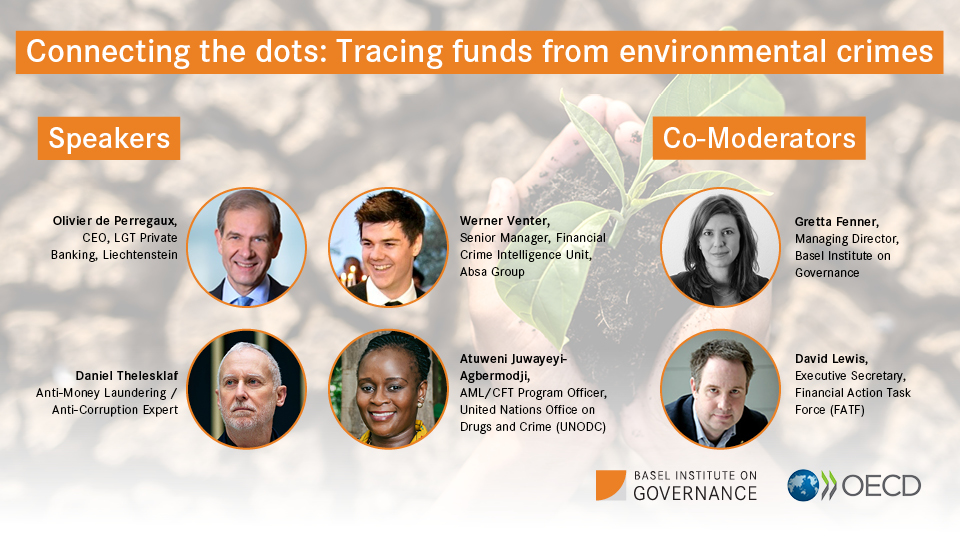

Titled Connecting the dots: Tracing funds from environmental crimes, the event on 17 March 2021 was part of the Corrupting the environment event series co-hosted by the OECD and the Basel Institute’s Green Corruption team.

Moderated by David Lewis, Executive Secretary of the FATF, the panel featured:

- Olivier de Perregaux, CEO LGT Private Banking, Liechtenstein

- Werner Venter, Senior Manager, Financial Crime Intelligence Unit, Absa Group Ltd.

- Daniel Thelesklaf, Anti-Money Laundering / Anti-Corruption Expert

- Atuweni Juwayeyi-Agbermodji, AML/CFT Program Officer, UNODC Southern Africa; former Director General, Financial Intelligence Agency, Malawi

Our next event on 14 April looks at how behavioural approaches can complement interventions to fight illegal wildlife trade and environmental crimes. You can register directly here.