Basel AML Index 2021: 4 things holding back the global fight against money laundering

Released today, the 10th annual edition of the Basel AML Index raises grave questions about whether jurisdictions are serious about tackling their money laundering and terrorist financing (ML/TF) risks, and what is holding them back.

The Basel AML Index is an independent annual ranking that assesses ML/TF threats around the world and the capacity of jurisdictions’ anti-money laundering and counter financing of terrorism (AML/CFT) measures to address their specific risks.

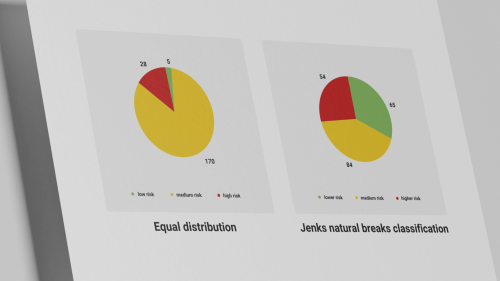

The average global money laundering risk score increased from 5.22 to 5.3 out of 10, as assessed across all 110 jurisdictions in the 2021 Public Edition of the Basel AML Index.

Even among jurisdictions whose risk scores improved this year, none managed to improve by even one point out of 10. Half of improvements were 0.3 of a point or less.

What is holding jurisdictions back from effectively tackling their ML/TF risks and avoiding being the weak spot in regional and international financial systems? This year’s Basel AML Index report looks at four areas of AML/CFT policy that urgently need more attention.

1 – A strong response to threats from virtual assets

The use of virtual assets such as cryptocurrencies is exploding – for legitimate as well as illicit purposes. This year’s Basel AML Index report analyses data from the Financial Action Task Force (FATF) on how jurisdictions are responding to ML/TF threats related to virtual assets.

The answer: not well at all. Most jurisdictions assessed or re-assessed in the last year have worsened their scores for technical compliance with FATF Recommendation 15 on virtual assets and virtual asset service providers. Average compliance levels have dropped by 10 percentage points globally.

Read the report to find out why.

2 – Effective prevention, not just enforcement

Previous editions of the Basel AML Index have lamented that many jurisdictions have AML/CFT systems that are mostly compliant with FATF technical recommendations but are ineffective in practice.

This year’s report looks at the distinction between compliance with technical recommendations vs effective implementation. Does the problem prevail for both prevention and enforcement?

The analysis reveals that:

- once again, jurisdictions score rather badly for effective implementation across the board;

- the discrepancy between technical compliance and effective implementation is even worse in relation to prevention.

These findings should ring an alarm bell for policy makers. Jurisdictions should invest more resources in the prevention of ML/TF, without reducing resources for enforcement.

3 - Beneficial ownership transparency

Beneficial ownership transparency is directly related to the effectiveness of a jurisdiction’s AML systems and the essential role of these systems in preventing, detecting, prosecuting and sanctioning financial crimes.

The Basel AML Index report analyses the implementation of beneficial ownership registers around the world. It shows how slow and ineffective implementation of beneficial ownership transparency measures continues to provide safe havens for dirty money.

This is damaging for individual jurisdictions, but more importantly undermines all global efforts to combat money laundering.

4 – Addressing ML/TF vulnerabilities beyond the financial sector

The final issue highlighted by the Basel AML Index data analysis is the generally weak application of AML/CFT preventive measures by lawyers, accountants, real estate agents and other designated non-financial businesses and professions non-financial entities (DNFBPs).

This means that there is a significant risk that such businesses and professions remain open to abuse by criminals and corrupt individuals wishing to launder their money. Moreover, there is increasing concern among regulators that:

- some DNFBPs are advising and assisting criminal clients with hiding and laundering illicit funds;

- as some high-profile cases have shown, accountants are used as intermediaries to avoid scrutiny.

At a minimum, more supervision over DNFBPs is urgently needed. Certain jurisdictions should also tighten their regulatory framework – and ensure that it is effectively enforced – over selected groups of DNFBPs in line with their risk exposure.

Regional deep dives

For a second year, the report offers profiles of money laundering risks in different regions. Our regional infographics show how jurisdictions score in relation to each other – and in too many cases let their neighbours down.

Policymakers should analyse their respective jurisdictions’ risks and make plans for serious reform. No jurisdiction is doing well. We call on all jurisdictions to step up their game.

See the report and website

- For a full results, analysis and interactive comparison tables, plus the opportunity to demo or subscribe to the Expert Edition, see our new Basel AML Index website: index.baselgovernance.org

- Download the press release

- Download the 2021 report (PDF)